A business might spend a lot of time to create invoices, sending the invoices out, and follow up on delayed payments. This is a fundamental operation that all businesses must perform to be successful. Furthermore, repeating invoices would be costing you money without your awareness. This may not be a problem for your company right now, but as it expands, so will the problem. So, before the situation worsens, it is best to switch to online invoicing, as the saying goes, “prevention is better than cure.”

Online invoicing is a great replacement for outdated invoicing methods. Xero is a brilliant option to explore since it can efficiently handle all your invoicing operations, saving your company both time and money.

With Xero you can customize your quote and invoice according to your needs. Most of our clients will asked for a custom invoice template because the sale invoice can be custom.

Advantages of Xero Quotes

- Time Saving

Xero can easily generate quotations from anywhere. It will save you a lot of time when creating and sending quotations to your clients. You may simply submit the quotations using the contact, inventory, and price information that you’ve put up in Xero. The quotation can send right away, no matter where you are by using your smartphone. - Increase Client confidence

You may design your own quotations in Xero by utilising the Xero custom templates, or you can just utilise the standard templates and add your logo. There’s a selection of well-designed templates ready to go. You should be able to drop in your logo, add your payment terms, and start pumping out invoices. This will make your quotations appear more professional and increase the client’s confidence in accepting your quotation. - Easily Check Status of the Quote

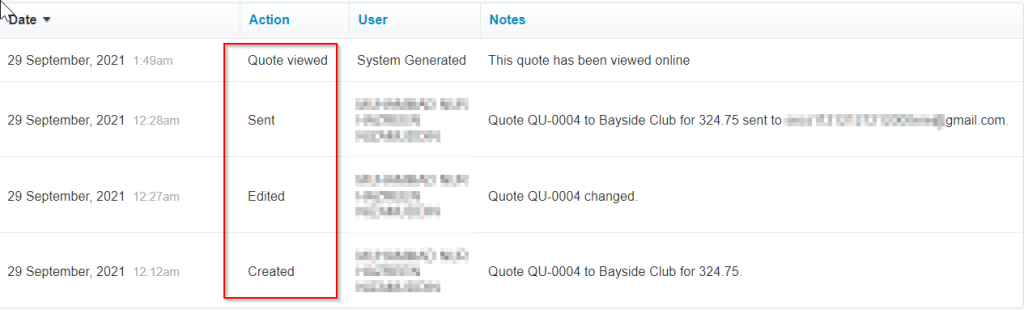

With Xero quotes you can check the status of quotes online. You can check which quotations have been sent out and whether they have been read as shown in Figure 1. This is useful information to have when the due date is approaching.

To see if your quotations have been approved or if you need to follow up, just look them up in Xero invoices. With the press of a button, your clients can accept, decline, or comment on the quote as in Figure 2. If necessary, you may easily amend and resend a quote. - Automated Data Entry

Xero quote really save up your time and avoid any data entry errors because when the clients accepted the quote you can easily turn the quotes into invoices by click the “Create Invoice” button as shown in Figure 3. When you create an invoice, it automatically gets all the information from the quote. You can change, add, or remove things as needed.

Advantages of Xero Invoicing

- Send Invoice on the spot

Xero invoice allows you to request payments more efficiently and you no longer have to wait for a bookkeeper to produce the invoice because you can easily create an invoice with all the data from inventory, contact, and price information. You can send invoices on the spot for faster payment from the clients. - Repeating Invoice

Invoices are recorded and kept as soon as they are created, allowing for efficient payment tracking. Need to create the same invoice for the same customer every month? No worries! Xero also enables for a repeating invoice. You can easily set up repeating invoices and send it each month to make sure you get the regular payment on time. For example, if you’re a digital marketing agency and you do digital marketing for your clients and need to repeat the invoices and automate the process, Xero can help you with this and save you a lot of time. - Automate Reminders Invoice

You can generate automated invoice reminders for your clients using Xero. You may enable invoice reminders to notify your customers when an invoice’s due date is approaching in case they missed the deadline to pay the invoice. When you initially enable invoice reminders in Xero, three default reminders are set up. The reminders are sent out 7, 14, and 21 days following the due date of each invoice (overdue). You may modify or delete these reminders based on your organization’s needs, from personalizing the reminder email to adjusting the time it is delivered. - Faster Payment with Online Invoice

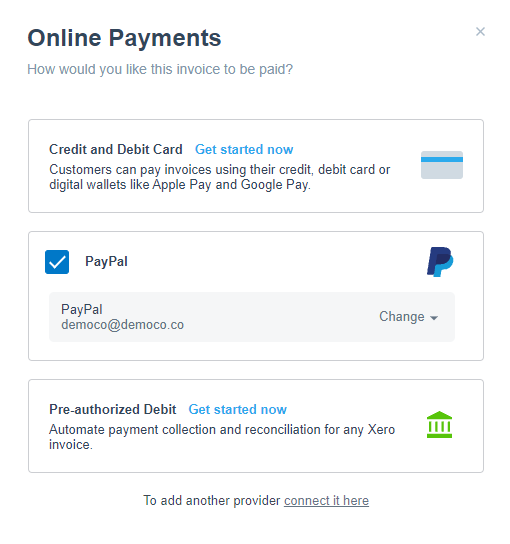

Most SMEs fail in the first few years due to a lack of cash flow and are unable to endure those difficult times, and Xero does give one feature that can assist any firm that is experiencing the same issue. Xero instant invoice payments online allow you to accept payments online through PayPal, Stripe, and other payment solutions as in Figure 4.

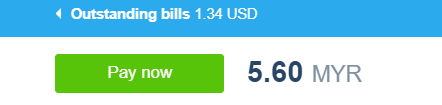

This improved automation in the process and keeps the cash coming to you. Good cash flow can be achieved in this way because you are giving your clients the ability to pay quickly. By integrating payment solutions like Stripe into your invoices, you can automatically add a “Pay Now” button to your online invoices, making it easier for clients to pay as in Figure 5. Stripe enables your clients to pay by credit card, debit card, Apple Pay and Google Pay. Besides this, you can add additional payment methods by creating a custom payment URL that will link to your preferred payment method.

If you’re using spreadsheets to manage your finances, you’re probably not always aware of your workflow and the status of quotes and invoices in the sales process. It is critical to always have this information readily available. Accounting software like Xero allows you to view a summary of all active quotes and invoices, including draft, sent, accepted, and expired quotes. This makes it simple to track the status of a quote and invoice, follow up on quotes and invoice sent but not accepted, and generally keep your business moving forward.