Stamp Duty

What is Stamp Duty?

Stamp duty is imposed on instruments, not on transactions. Instruments subject to stamp duty include agreements, contracts, deeds, licences, and other documents specified under the Stamp …

Stamp duty is imposed on instruments, not on transactions. Instruments subject to stamp duty include agreements, contracts, deeds, licences, and other documents specified under the Stamp …

In Malaysia, the Income Tax Act 1967 taxes income from real property as either a business source under Section 4(a) or a non-business source under Section 4(d). This classification determines…

If your company’s primary activity is holding investments, it is essential to know if you qualify as an Investment Holding Company (IHC) under Malaysian tax law. This classification determines how …

Reinvestment Allowance is a tax incentive aimed at encouraging existing manufacturers to reinvest in their operations. Eligible companies can claim a deduction of 60% of qualifying capital expenditure incurred on …

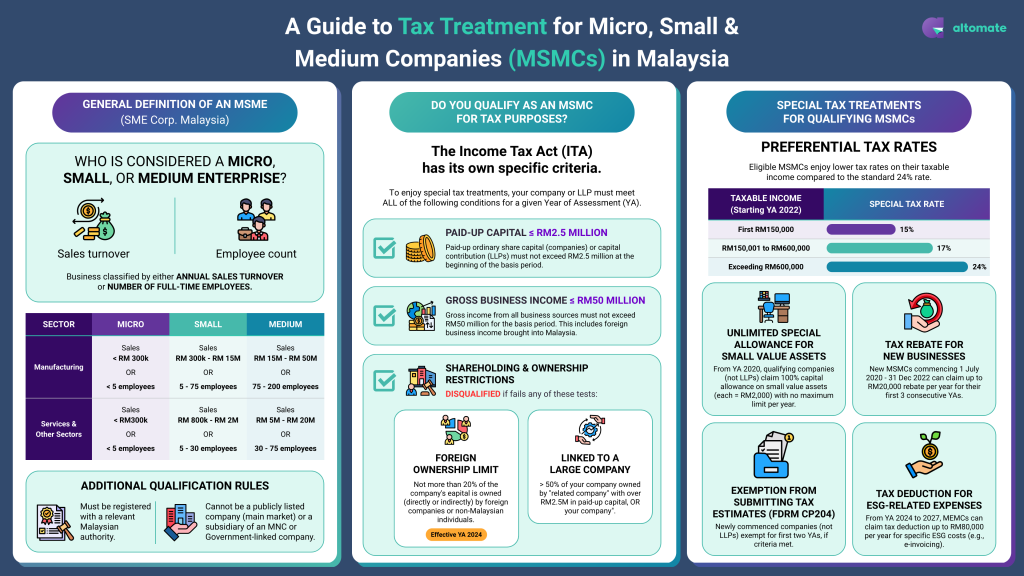

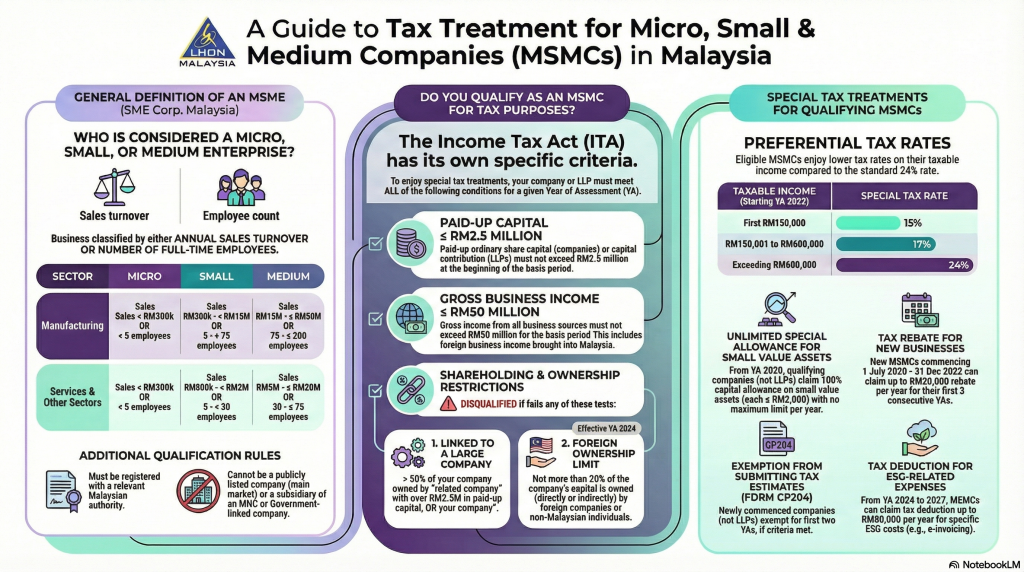

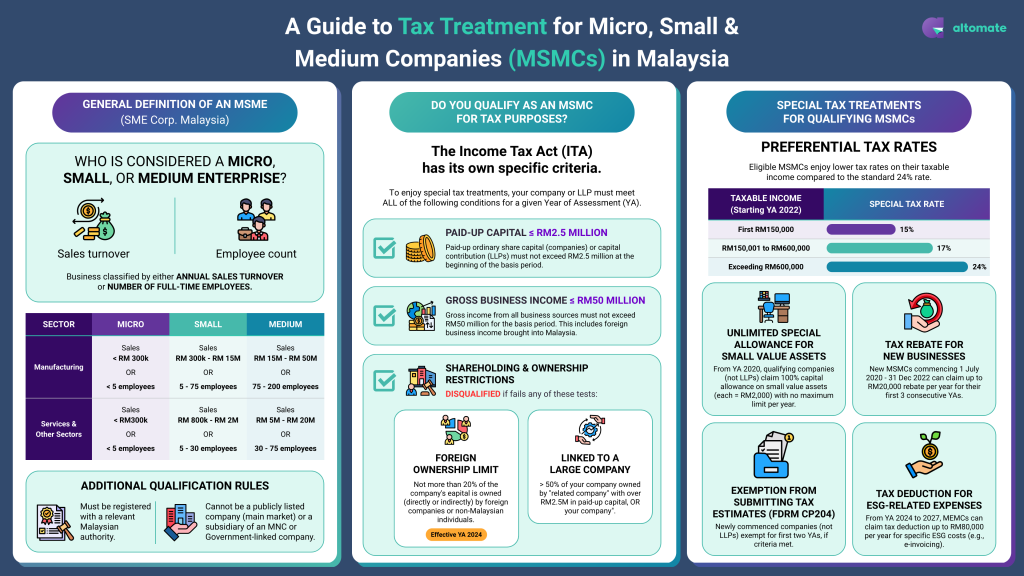

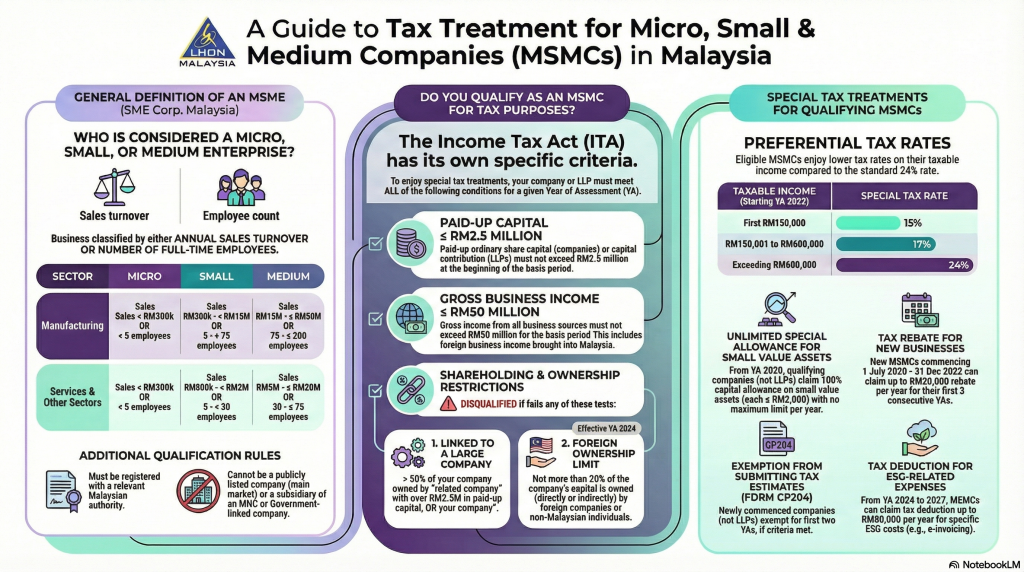

Under the Malaysian tax system, MSMCs enjoy specific tax incentives and tax treatment designed to support small and medium enterprises. This comprehensive guide details the tax obligations, tax benefits, and …

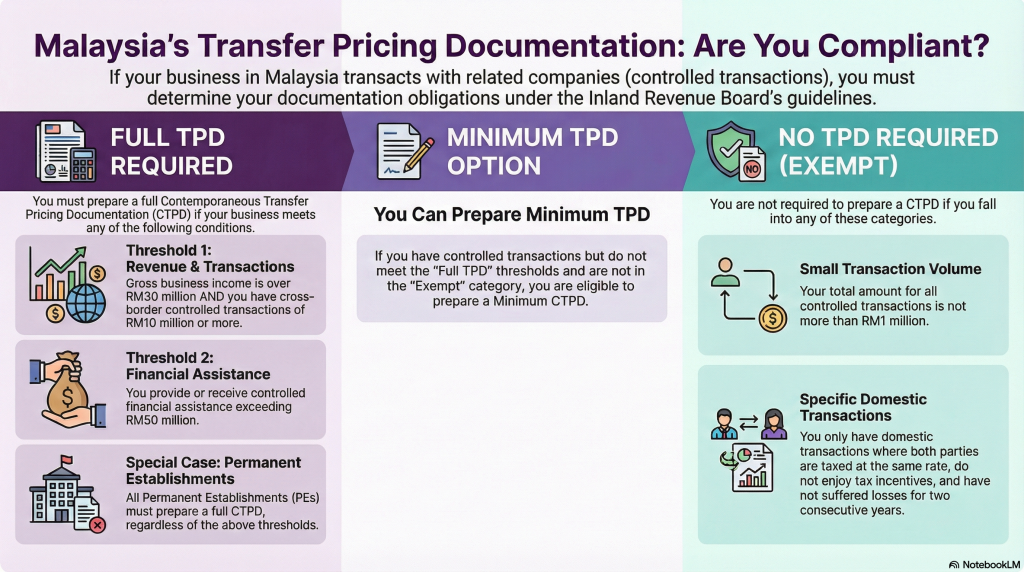

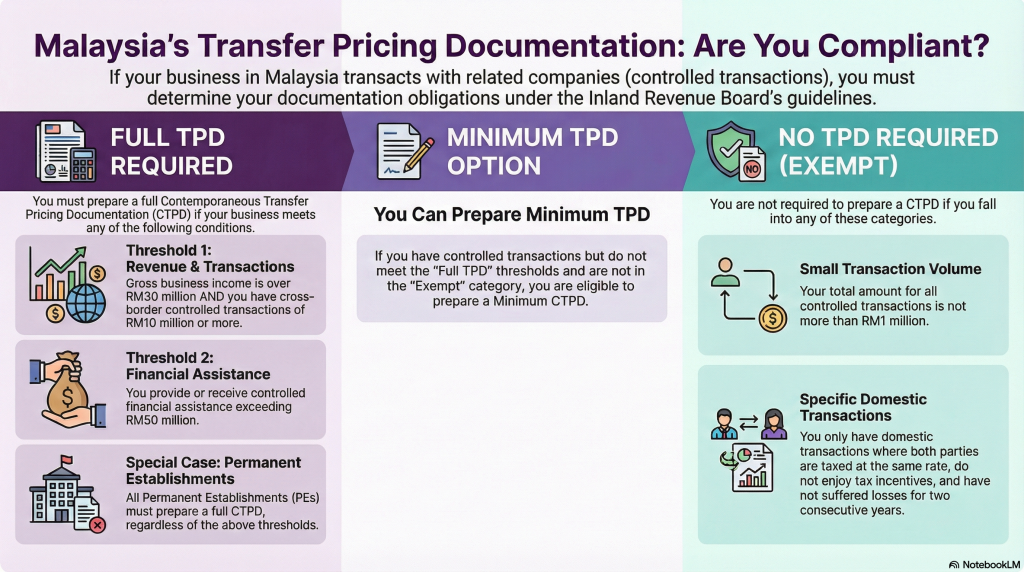

The Malaysia Transfer Pricing Guidelines 2024 (“MTPG 2024”) represent a significant update to the country’s transfer pricing (TP) framework and are effective for years of assessment (YA) 2023 onwards. Issued …

Made by Altomate Support with Scribe

This guide provides a straightforward process for opening an OCBC e-biz account, ensuring users can easily navigate the

…Related Services: Digital Company Secretary Service

At Altomate, we are committed to providing timely corporate services. Here are our service turnaround times to help you plan with confidence.

Our typical …

Related Services: Digital Company Secretary Service

Notes:

Related Services: Digital Company Secretary Service

*For a detailed list of Company Secretary fees, please refer to the following table: Company Secretary – Detailed Fee Schedule…

Stamp duty is imposed on instruments, not on transactions. Instruments subject to stamp duty include agreements, contracts, deeds, licences, and other documents specified under the Stamp …

In Malaysia, the Income Tax Act 1967 taxes income from real property as either a business source under Section 4(a) or a non-business source under Section 4(d). This classification determines…

If your company’s primary activity is holding investments, it is essential to know if you qualify as an Investment Holding Company (IHC) under Malaysian tax law. This classification determines how …

Reinvestment Allowance is a tax incentive aimed at encouraging existing manufacturers to reinvest in their operations. Eligible companies can claim a deduction of 60% of qualifying capital expenditure incurred on …

Under the Malaysian tax system, MSMCs enjoy specific tax incentives and tax treatment designed to support small and medium enterprises. This comprehensive guide details the tax obligations, tax benefits, and …

The Malaysia Transfer Pricing Guidelines 2024 (“MTPG 2024”) represent a significant update to the country’s transfer pricing (TP) framework and are effective for years of assessment (YA) 2023 onwards. Issued …

Made by Altomate Support with Scribe

This guide provides a straightforward process for opening an OCBC e-biz account, ensuring users can easily navigate the

…Related Services: Digital Company Secretary Service

At Altomate, we are committed to providing timely corporate services. Here are our service turnaround times to help you plan with confidence.

Our typical …

Related Services: Digital Company Secretary Service

Notes:

Related Services: Digital Company Secretary Service

*For a detailed list of Company Secretary fees, please refer to the following table: Company Secretary – Detailed Fee Schedule…

Nam at convallis turpis. Praesent gravida ultrices neque in pretium. Aenean sit amet dictum ligula. Proin nulla purus, ornare ut varius vitae, ultrices ac neque. Morbi bibendum urna luctus ligula suscipit dapibus.