This guide will walk you through the process of incorporating your company using SSM MyCoID’s Company Super Form (Section 14) and obtaining your Certificate of Incorporation of Private Company (Section 17).

Here is a quick overview of the process that takes about 1-2 days:

- Perform a Name Search.

- Fill out and Submit the Super Form.

- Make a payment of RM1,010.60 (includes tax).

- Respond to any SSM Officer questions.

- Receive Notice of Registration.

- Purchase your Certificate of Incorporation from an SSM authorized service portal.

Time-Saving Tip: If this process seems tedious, consider using the Digital Company Secretary method. It’s faster, and the incorporation service is free. Plus, you get a discount on the SSM fee. Check out our detailed comparison of all incorporation methods: “3 Ways to Incorporate Your Company in Malaysia: From Least to Most Practical“.

Before you start, make sure you have a MyCoID user account. If not, follow our guide on how to register, verify & activate your MyCoID account.

Let’s get started.

1. Perform a Company Name Search

A company name search is a mandatory first step that verifies if your desired business name is available for registration.

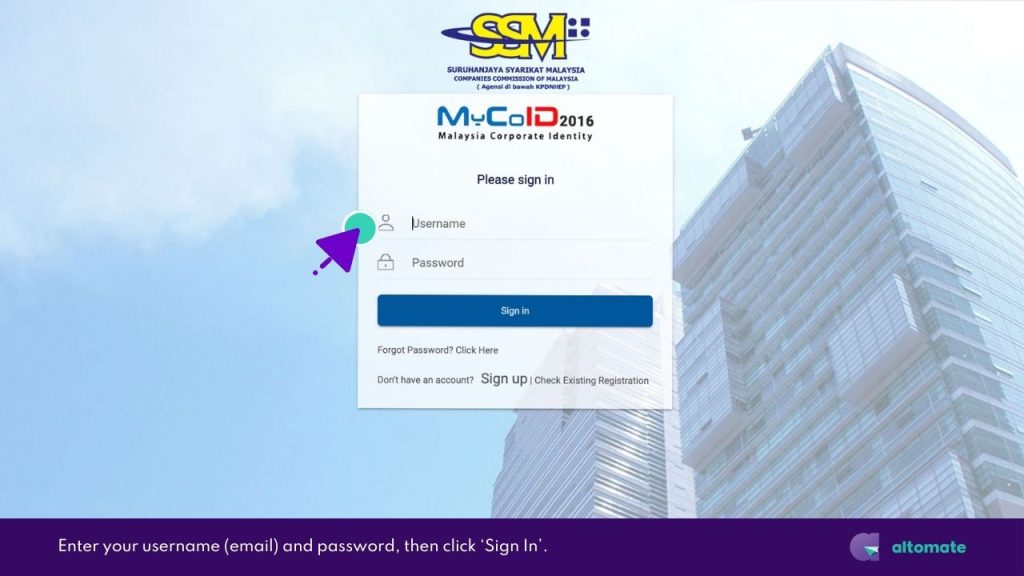

- Visit SSM’s MyCoID website.

- Click ‘Login / Sign up‘ in the top right corner.

- Enter your username (email) and password, then click ‘Sign In‘.

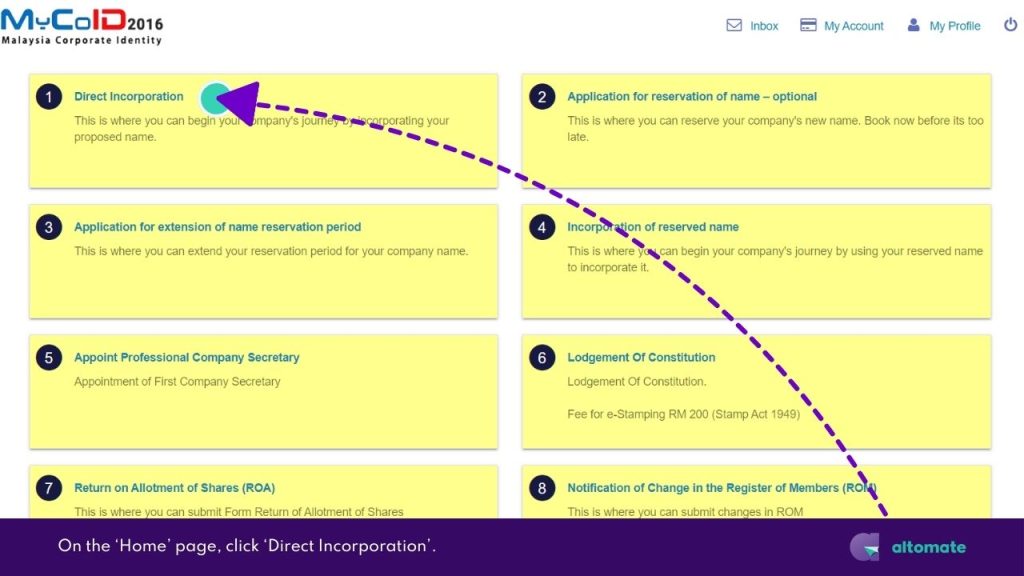

- On the Home page, click ‘Direct Incorporation‘.

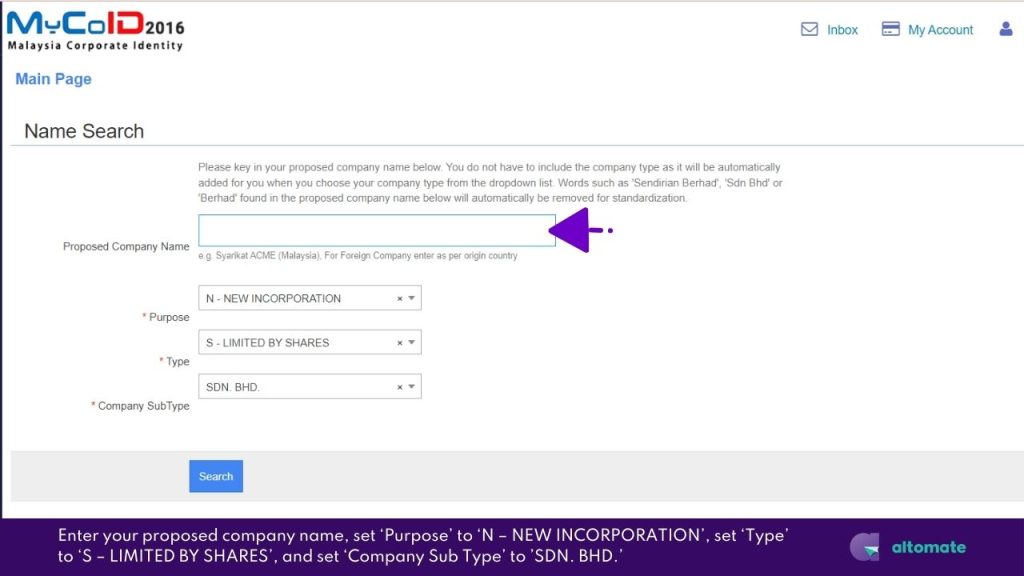

- On the Name Search page:

- Enter your proposed company name

- Set ‘Purpose‘ to ‘N – NEW INCORPORATION‘

- Set ‘Type‘ to ‘S – LIMITED BY SHARES‘

- Set ‘Company Sub Type‘ to ‘SDN. BHD.’

- Click ‘Search‘.

- If the name is available, click ‘Submit‘ to proceed with incorporation. For a new search, click ‘New Search‘.

Have a licensed professional handle your Company Incorporation AND for RM999 instead of RM1,040.60 (SSM Application Fee + Certificate of Incorporation). Our Essential Incorporation & Digital Company Secretary package offers free incorporation service, all required CTC documents and more. Learn more here >>

2. Fill the Incorporation Application Form – Company Super Form (Section 14)

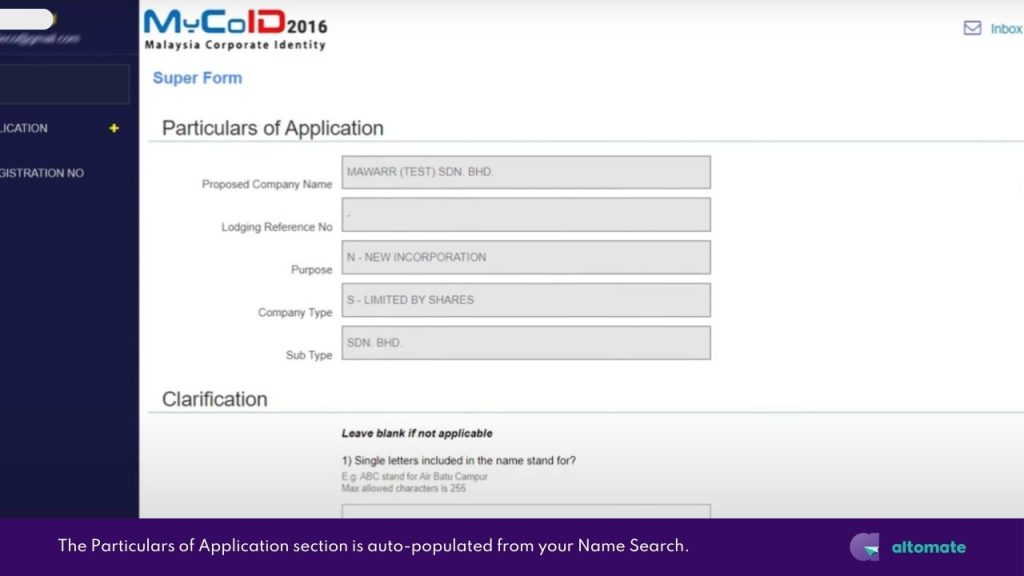

After clicking ‘Submit’ from the Name Search page, you will be redirected to the Super Form page.

» Section A: Particulars of Application

This section is auto-populated from your Name Search. No action required.

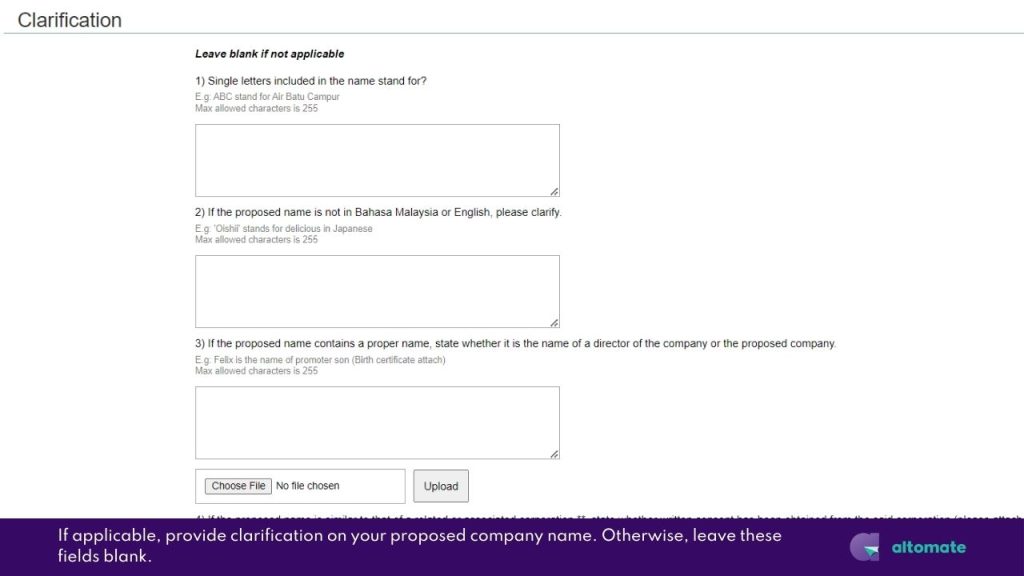

» Section B: Clarification

- If applicable, provide clarification on your proposed company name. Otherwise, leave these fields blank.

- Text box (3) – If your company name contains the name of an individual who is not a director and is a director’s family member:

- In the text box, describe the relationship between the named individual and the director.

- (Required) Attach proof of relationship.

E.g.: If the proposed name is ‘Ali Technology’, explain that Ali is the director’s son and attach a copy of Ali’s birth certificate as proof of relationship.

- Text box (4) – If your company name contains words similar to a related or associated corporation:

- In the text box, describe your usage and your affiliation with the corporation.

- (Required) Attach a consent letter or resolution from the corporation.

- Text box (5) – If your company name contains words that are trademarked:

- In the text box, describe your usage and your affiliation with the trademark owner.

- (Required) Attach a consent letter from the trademark owner.

- Text box (6) Other comments – If your company name contains controlled words:

- In the text box, describe your usage of the controlled words.

- (Required) Attach a letter of permission from the relevant authority.

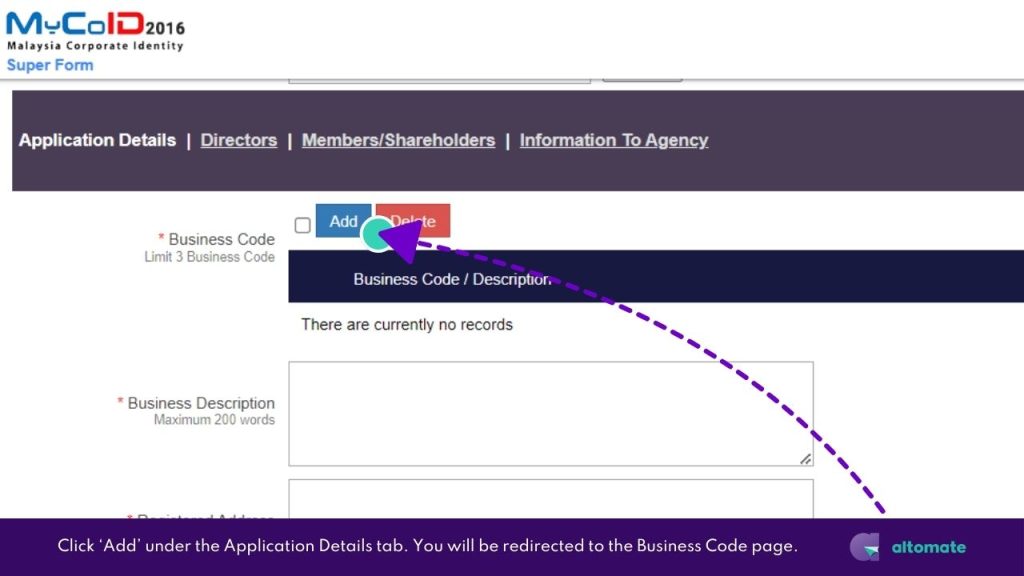

» Section C : Application Details

- Add Business Codes

- Click ‘Add‘ under the Application Details tab. You will be redirected to the Business Code (MSIC Code) page.

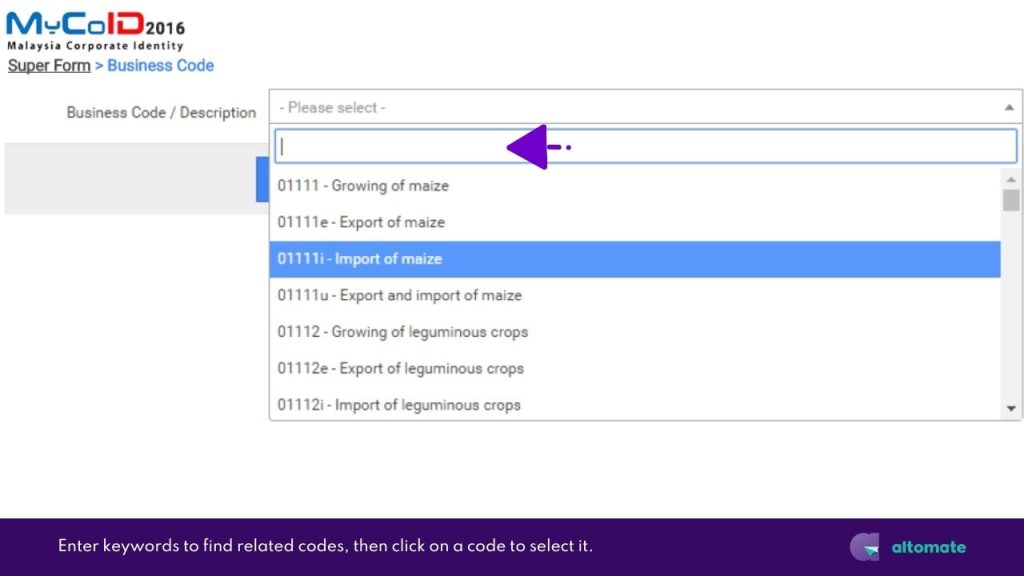

- Open the drop-down list and enter keywords in the search field to find related codes.

- Select a code by clicking on it.

- Click ‘Save‘. You will be returned to the Super Form page. The selected code will appear in the Business Code / Description table.

- To add more codes repeat steps no. 1-4. You are allowed to select up to 3 business codes.

E.g.: Altomate’s business codes are,

62099 Other information technology service activities n.e.c.

69200 Accounting, bookkeeping and auditing activities; tax consultancy

70209 Other management consultancy activities n.e.c.

- Describe Your Business

- Provide a detailed Business Description. Make sure to include details that are not covered by your business codes.

E.g.: Altomate’s business description is “To carry on the business of providing digital company secretarial services and other related corporate services, to offer comprehensive bookkeeping, tax compliance, and consultancy services, to deliver payroll management solutions, to facilitate POS & e-commerce integration with accounting software, and to provide other information technology service activities. Additionally, to act as a digital business assistant and enabler, supporting startups, SMBs, and SMEs in their growth and compliance efforts, and to offer management consultancy services and other related business support services.”

- Enter the company’s official address for legal correspondence in the Registered Address field.

- If the Business Address is identical to the Registered Address, check the ‘SAME AS ABOVE‘ box. The Business Address is where the company’s main operations.

- Otherwise, enter the Business Address separately.

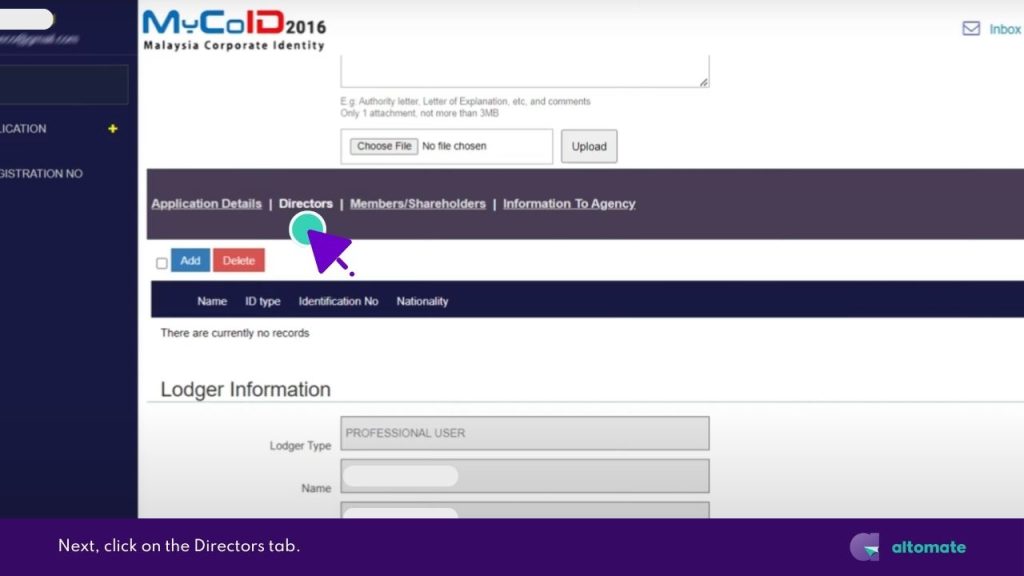

» Section C : Directors

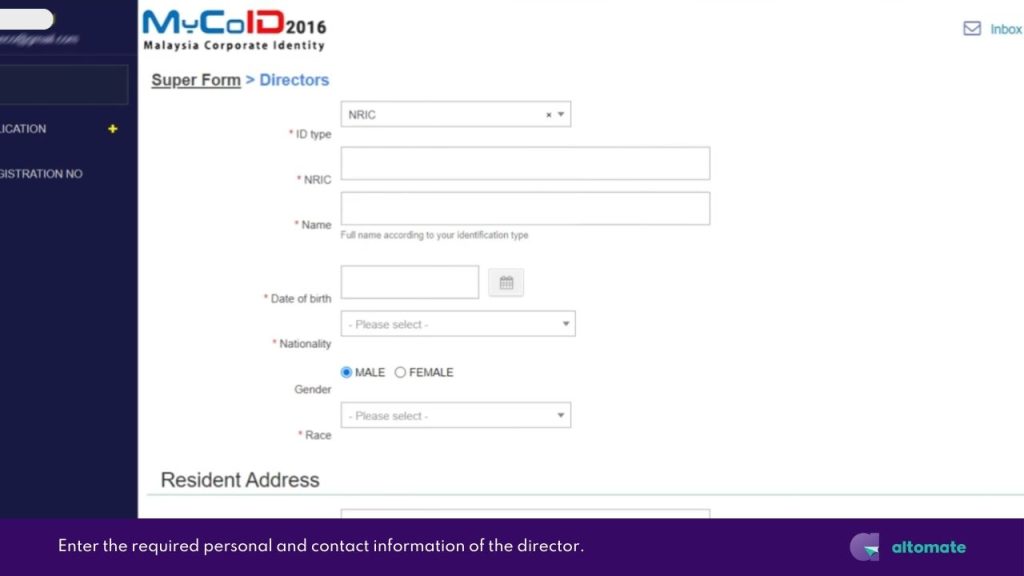

- Next, click on the Directors tab, located next to Application Details.

- In the Directors tab, if you registered as an Individual during user registration, you should be automatically listed as a director of the company.

- If you’re the sole owner or your company has only one director, you can skip to the next section – Section C: Members/Shareholders.

- To add more directors, click ‘Add‘. You will be redirected to a separate page.

- Enter the required personal and contact information of the director.

- Check the box declaring the person is not disqualified under Companies Act 2016 and has consented to his role as director.

- If the added director is also a member/shareholder of the company, check the box for “THIS PERSON IS ALSO A MEMBER”.

- Click ‘Save’ to add the director. You will be returned to the Super Form page.

- Repeat steps no. 4-8 to add more directors.

» Section C : Members/Shareholders

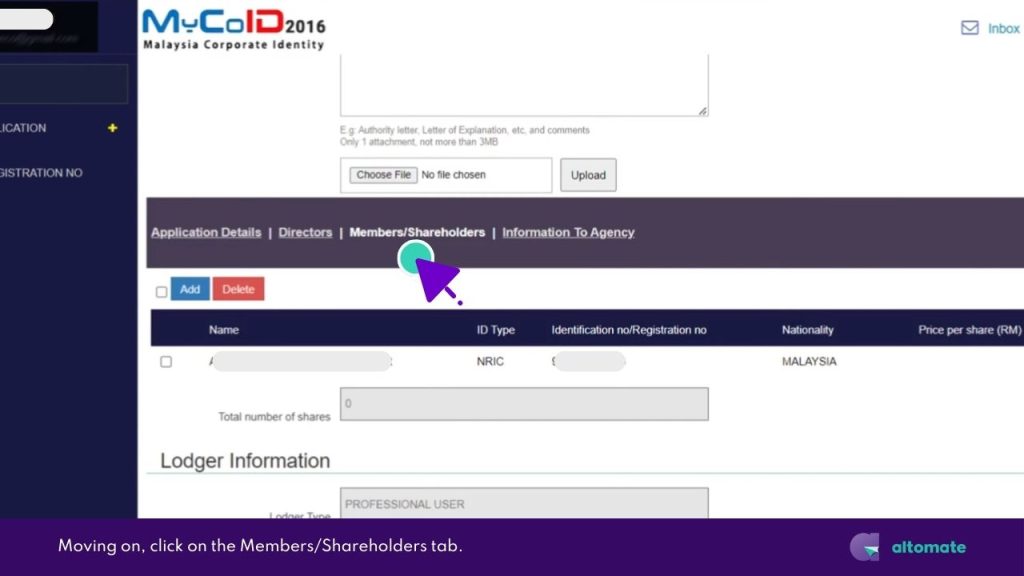

- Moving on, click on the Members/Shareholders tab.

- If you’re a Director, you should be automatically listed here.

- If you’re the sole owner, you can skip to the next section – Section C: Information to Agency.

- To add more members/shareholders, click ‘Add‘. You will be redirected to the Members page.

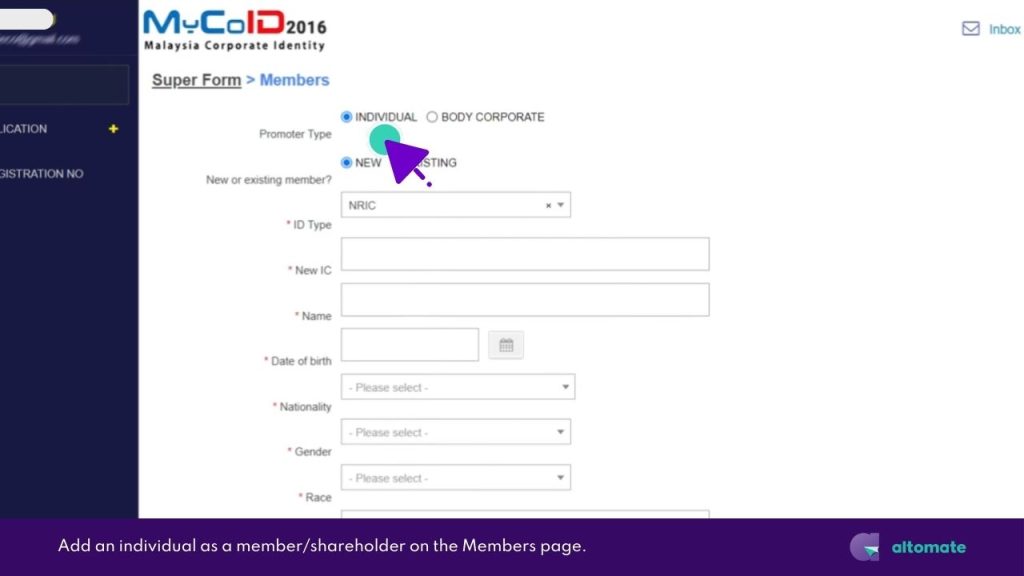

- To add an individual as a member/shareholder:

- Select ‘Individual‘ as Promoter Type.

- For members with a MyCoID account:

- Choose ‘EXISTING‘ for ‘New or existing member?‘

- Select ID Type and enter the identification number.

- Click ‘Search‘ and verify the displayed information.

- For members without a MyCoID account:

- Choose ‘NEW‘ for ‘New or existing member?‘

- Enter the required personal and contact information.

- Enter share details:

- Price per share: RM1

- Number of shares

- Class of Share: ‘Ordinary‘

- Check the compliance declaration box.

- Click ‘Save‘ to add individual as member/shareholder. You will be returned to the Super Form page.

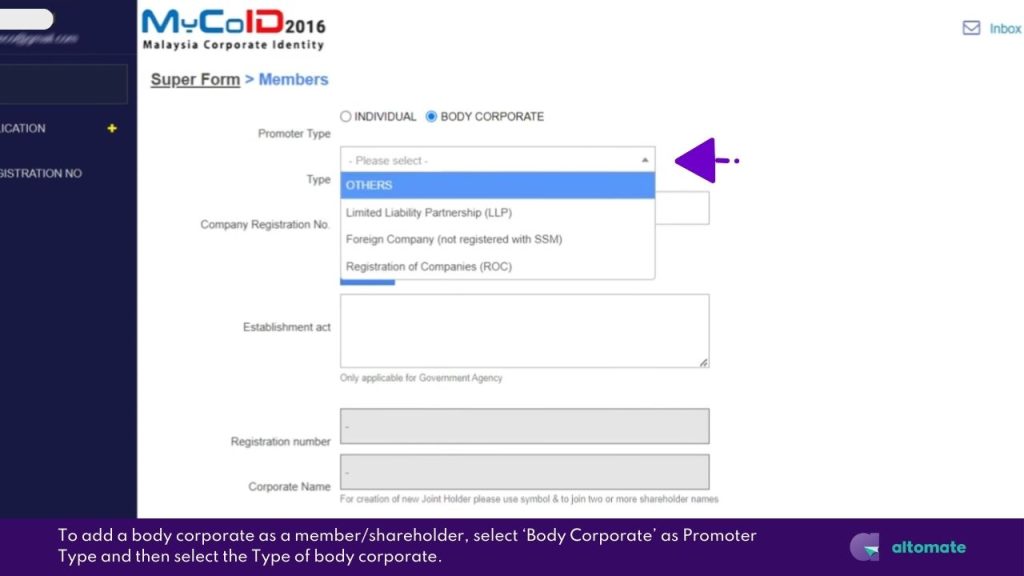

- To add a body corporate as a member/shareholder:

- Select ‘Body Corporate‘ as Promoter Type.

- Select the Type of body corporate, then:

- If type is Limited Liability Partnership (LLP),

- Enter the old company registration number (e.g. LLP0008212-LGN).

- Click ‘Search‘.

- If type is Registration of Companies (ROC),

- Enter an old company registration number (e.g. 1162572-D).

- Click ‘Search‘.

- If type is a Government Agency,

- Select Others.

- Then select from list of ‘Govt Agency and Other Shareholder‘.

- Enter the Establishment act.

- If type is Limited Liability Partnership (LLP),

- Information will be displayed for existing body corporate.

- Enter share details:

- Price per share: RM1

- Number of shares

- Class of Share: ‘Ordinary‘

- In the Representative of Body Corporate section, enter the required personal and contact information of the representative.

- Upload consent letter or resolution by body corporate to appoint a corporate representative to represent the corporate shareholder in executing documents.

- Click ‘Save‘ to add body corporate as member/shareholder. You will be returned to the Super Form page.

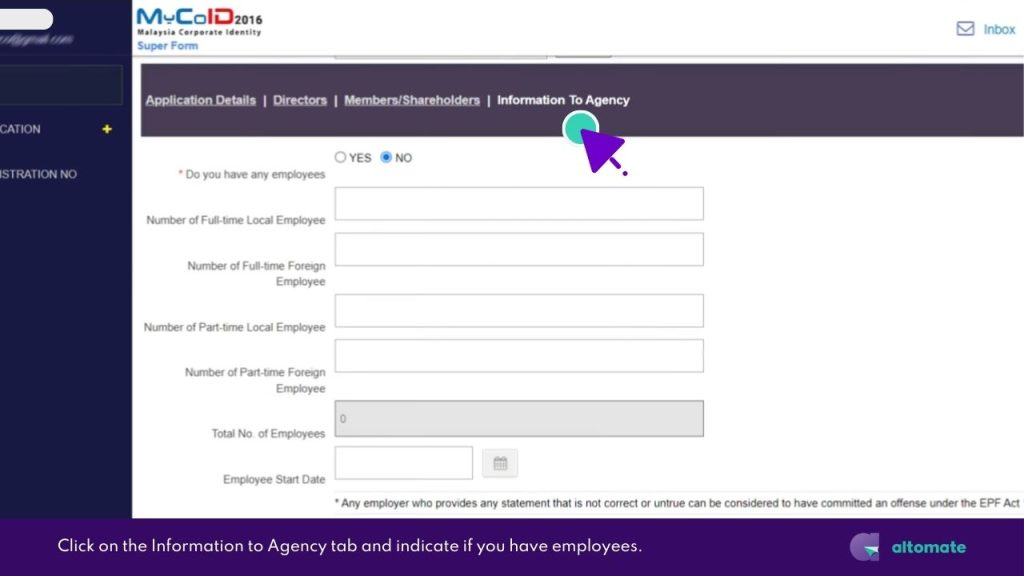

» Section C : Information to Agency

- Click on the Information to Agency tab.

- Indicate if you have employees:

- Select ‘NO‘ if you don’t have employees, then move to the next section.

- Select ‘YES‘ if you have employees and provide the following details:

- Number of full-time local and foreign employees

- Number of part-time local and foreign employees

- Employee start date

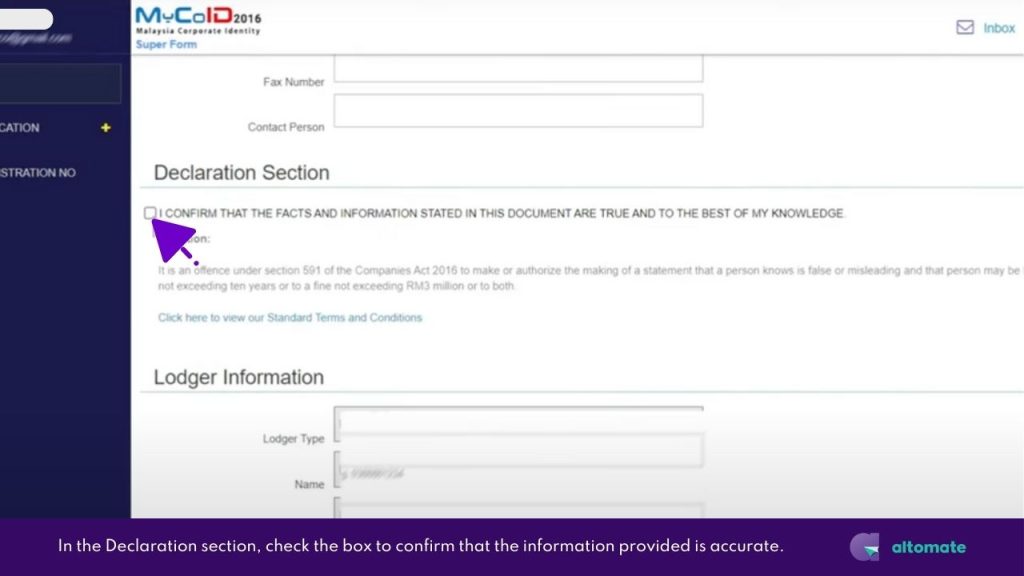

» Section D : Declaration Section

- In the Declaration Section, check the box to confirm the information is accurate.

» Section E : Lodger information

- In the Lodger Information section, verify the information is correct. The information here is from the Name Search application.

- Click ‘Next‘ to preview your Super Form.

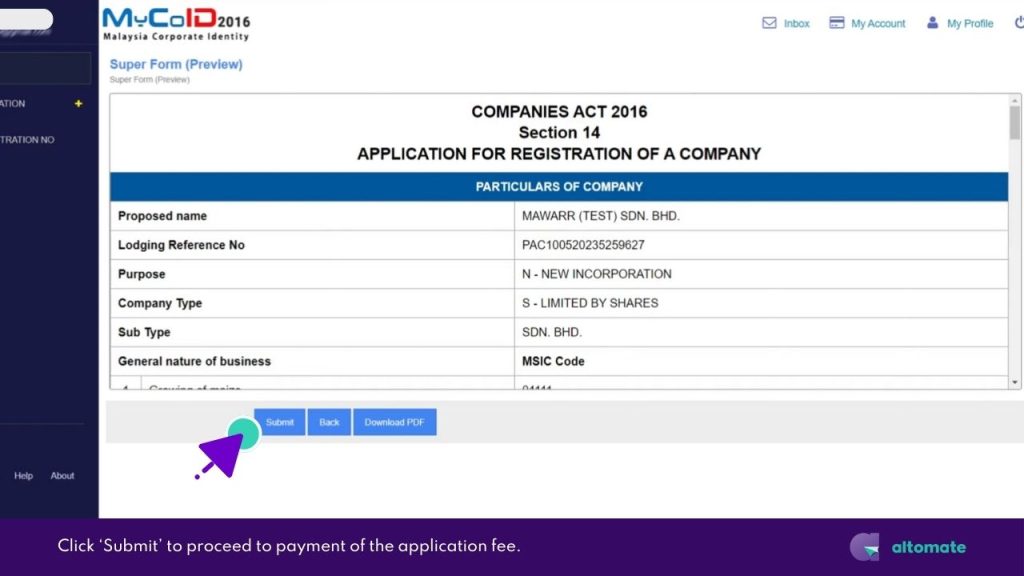

Super Form Preview Page

On the Super Form preview page, take the opportunity to do a final check of the information you’ve entered. If you need to make changes, simply click ‘Back‘.

You can download the preview as a PDF by clicking ‘Download PDF’.

When you’re ready, click ‘Submit‘. You will then be redirected to the Transaction page to pay the application fee.

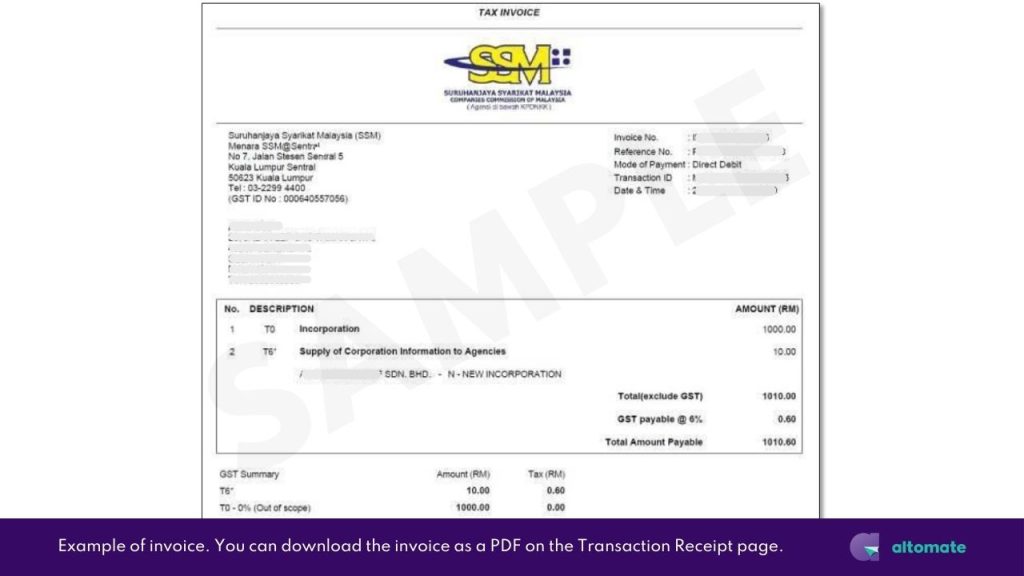

Make Payment to Complete Your Super Form Submission

- On the Transaction page, scroll down to the Payment Detail section.

- Select ‘NEW‘ for ‘Use Existing Payment Derail or New?‘.

- Enter the required billing information.

- Click ‘Pay‘ to proceed.

Your Incorporation Application costs RM1,010.60 and includes:- Company Incorporation fee: RM1,000.00

- Supply of Corporation Information to Agencies: RM10.00

- GST (6%) on Supply of Corporation Information: RM0.60

- Upon successful payment, you’ll be redirected to a Transaction Receipt page. From here, you can download the invoice as a PDF.

- Your company incorporation application is now successfully submitted.

What Is ‘Supply of Corporation Information to Agencies’ Fee?

Upon SSM approval of your incorporation, you’ll receive a unique Malaysia Corporate Identity Number (MyCoID), which serves as your company registration number.

The ‘Supply of Corporation Information to Agencies’ is a mandatory fee charged by SSM to register your MyCoID number and company information with several key government agencies:

- Inland Revenue Board (LHDN)

- Employees Provident Fund (KWSP)

- Human Resource Development Corporation (HRD Corp)

- Social Security Organisation (PERKESO)

- Small and Medium Enterprise Corporation Malaysia (SME Corp Malaysia)

Sharing this information makes reference for registration and transaction purposes with different Government agencies easier.

SSM’s Incorporation Review Process

After submitting your application, keep an eye on your email. An SSM officer may query your application if there are issues.

If you receive an email notification that your application has been queried, follow these steps to edit and resubmit your application:

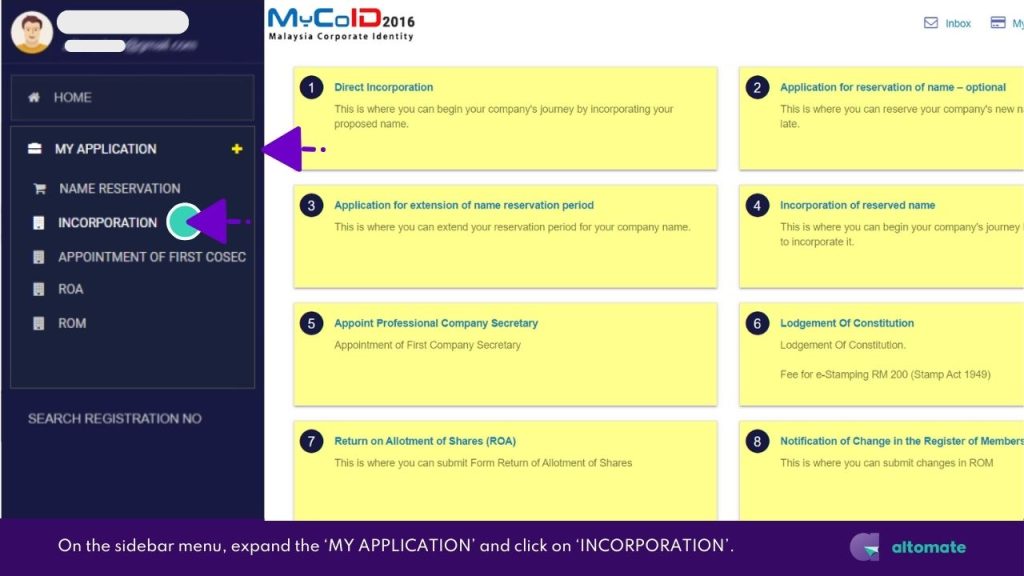

- Log in to MyCoID2016.

- On the sidebar menu, expand the ‘MY APPLICATION‘ and click on ‘INCORPORATION‘.

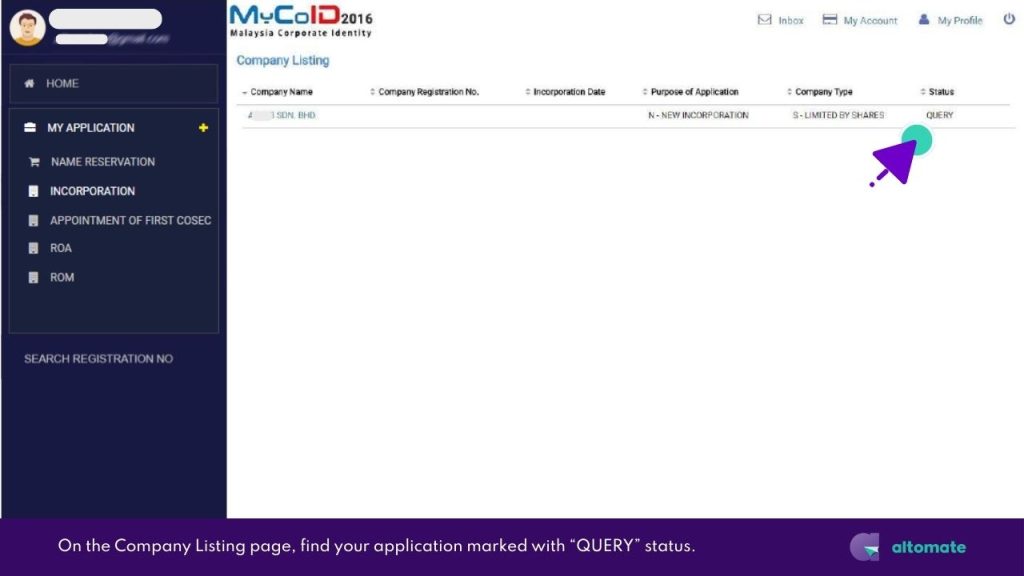

- On the Company Listing page, find your application marked with “QUERY” status.

- Click on the company name. You will be redirected to the Super Form page.

- On the Super Form page, select ‘Edit Data‘.

- Make the necessary amendments.

- Click ‘Save‘ to resubmit your application. You will be redirected to a confirmation page.

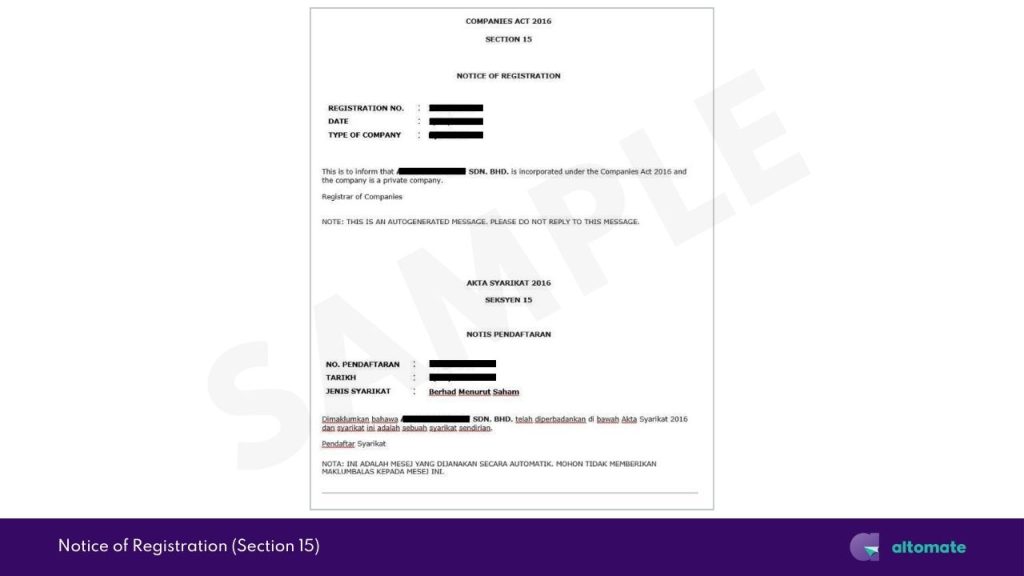

SSM Will Send You a Notice of Registration (Section 15) as Proof of Incorporation

When your application is approved, you will receive an email with the subject “Notice of Registration“. This confirms your company’s incorporation.

The Notice of Registration is just a notification. It can’t be used for opening bank accounts or applying for licenses. For these purposes, you’ll need the Certificate of Incorporation (Section 17).

Government institutions and banks only accept the Certificate of Incorporation(Section 17) as proof of incorporation.

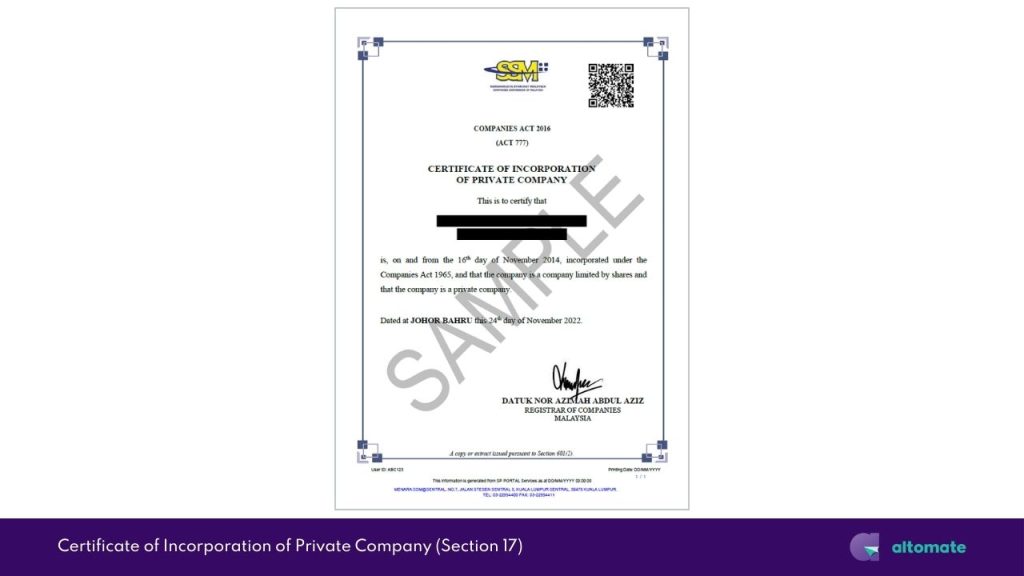

Getting Your Certificate of Incorporation (Section 17)

The Certificate of Incorporation as it is required by government institutions, banks and financial service providers as proof of incorporation.

This certificate is not issued automatically. You have to purchase it separately from the SSM authorised service provider portals in this list:

- SSM e-Info: https://www.ssm-einfo.my

- MyDATA-SSM: https://www.mydata-ssm.com.my

- SSM Search: https://www.ssmsearch.com

- SSM SAFEDATA: https://www.safedata-ssm.com

The cost of a Certificate of Incorporation with CTC varies depending on the service provider portal you choose. Currently, the lowest fee we’ve found is from the ‘SSM Search portal’, which charges RM30.00, excluding tax.

If this all sounds like a lot of work, why not incorporate using Altomate AND pay less? Check out our Essential Incorporation & Digital Company Secretary package. It includes free incorporation service, all the required CTC documents and more. Learn more now >>