Under the Malaysian tax system, MSMCs enjoy specific tax incentives and tax treatment designed to support small and medium enterprises. This comprehensive guide details the tax obligations, tax benefits, and the latest tax regulations as of 2025.

What is an MSMC under the ITA?

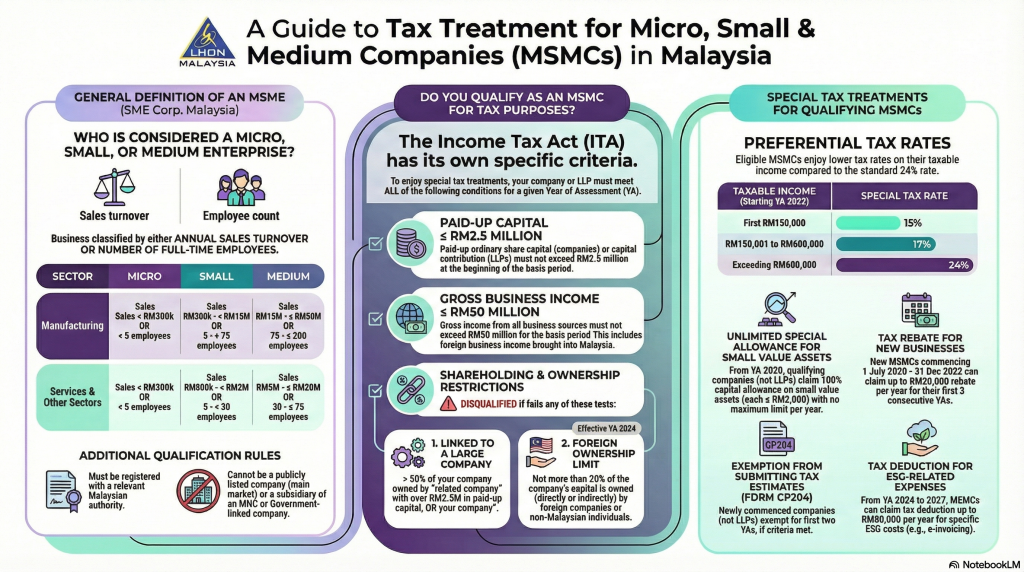

While the general small and medium enterprise definition is set by SME Corp., the Inland Revenue Board (IRBM) applies specific criteria under the Income Tax Act 1967 (ITA) for a separate legal entity to qualify as an MSMC:

- Residence & Incorporation: Must be a resident and incorporated in Malaysia as a company or registered as a limited liability partnership (LLP).

- Paid-up Capital: Must have a paid-up ordinary share capital (for companies) or capital contribution (for LLPs) not exceeding RM2.5 million at the start of the basis period.

- Gross Business Income: Total gross income from all business activities must not exceed RM50 million in the basis period.

- Shareholding Restrictions: Effective from YA 2024, no more than 20% of the paid-up ordinary share capital may be owned, directly or indirectly, by a foreign company incorporated outside of Malaysia or a non-Malaysian individual.

Key Tax Incentives and Treatments

The Inland Revenue Board of Malaysia provides several incentives for SMEs in Malaysia to reduce their effective tax rate:

1. Special Tax Rates

Eligible MSMCs that meet the above criteria may enjoy preferential income tax rates on their taxable income. They are significantly lower than the standard corporate tax rate of 24%. Understanding MSMC Taxation, MSMCs are subject to income tax under Malaysian law if they earn taxable income that is:

– generated in Malaysia, or

– received in Malaysia from outside Malaysia.

Special Tax Rates for Eligible Companies and LLPs

| Taxable Income Layer | Tax Rate (YA 2023 onwards) |

| First RM150,000 | 15% |

| RM150,001 to RM600,000 | 17% |

| Exceeding RM600,000 | 24% |

Source: Table 5 of Public Ruling 8/2025.

2. Special Allowance for Small Value Assets

Companies can claim a special allowance for small value assets valued at RM2,000 of each asset and limited to RM20,000 for each YA. This tax treatment is effective from the YA 2020. There is no maximum limit on the qualifying plant expenditure (QPE) for special allowances that may be claimed for each. Year of Assessment (YA).

3. ESG Expenditure Deduction

To promote sustainable business practices, MSMCs can claim a tax deduction of up to RM50,000 per YA for expenses related to Environmental, Social, and Governance (ESG) initiatives for YA 2024 to 2027:

- Eligible expenses:

– Consultation fees for developing customized software for e-Invoice implementation

– Fees paid to external service providers for e-Invoice setup

- Excluded expenses:

– Costs at the planning or initial development stage of the software

– Consultation fees for issuing e-Invoices through the MyInvois Portal

4. Allowance for Increased Export Incentive:

To encourage companies to expand their exports.

- Companies can claim up to 70% income tax exemption on statutory business income for a YA. The exemption depends on:

- Type of export (agricultural produce or manufactured products)

- Value-added component of the exported goods

This incentive was applicable for YA 2016 to YA 2020

5. Tax Rebate for Establishment and Operation

Starting from YA 2021, companies and LLPs can claim a tax rebate when commencing business operations:

(1) The rebate is available for three consecutive YAs from the first YA of operations.

(2) The rebate is based on operating and/or capital expenditures, up to RM20,000 per YA.

6. First 2 YA exemption from Estimation of Tax Payable

Normally, companies, LLPs, trust bodies, and co-operative societies must estimate their tax payable and pay monthly installments for each YA using Form CP204.

- Applicants must submit their forms electronically at least 30 days before the start of the basis period.

- Tax is paid in equal monthly installments over the YA.

- Compliance with CP204 and CP204A is mandatory. Failure to pay installments may result in additional tax under Section 107C(9) of the ITA.

Special Tax Treatment for Developers, JMBs, and MCs

The tax treatment for developers, Joint Management Bodies (JMBs), and Management Corporations (MCs)involves unique rules regarding maintenance fees and sinking fund contributions:

- Mutuality Principle: The mutuality principle generally exempts income derived from building maintenance and management (such as maintenance fees) for JMBs and MCs.

- Sinking Fund: Tax authorities disregard sinking fund contributions and other management receipts if they come from members.

- Taxable Income: Examples of taxable income include interest income or rental income from third parties. These are subject to prevailing tax rates unless a specific exemption applies.

Tax Filing and Compliance for 2025

- E-Invoicing: Starting in 2025, e-invoicing will become a key requirement for businesses. Companies should adopt digital invoicing systems early to ensure compliance, minimize errors, and streamline tax filing processes.

- Audit and Records: Proper documentation and separate accounting records are crucial. Maintaining clear and accurate records facilitates efficient audits and reduces the risk of penalties or compliance issues with the IRB. These records should be retained for a period of 7 years, in line with regulatory requirements.

- Professional Advice: Tax laws can be complex; it is highly recommended to engage with tax professionals to develop a robust tax strategy.

For further details, refer to the technical guidelines in Bahasa Malaysia or the English translation from the original Bahasa Malaysia text provided by the IRBM. Always ensure your tax return is submitted in accordance with the Income Tax Act 1967.

Simplify Your Tax Compliance

Don’t let complex tax regulations slow your business down. Whether you need clarity on sinking fund treatments for management bodies or help calculating taxable income under the latest Public Ruling No. 8/2025, Altomate is here to help. Reach out to our team for support, or consult a tax professional to optimise your tax strategy.

Source: Tax Treatment for MSMC