Is Your App Tax-Ready? A Startup’s Guide to Sales and Service Tax (SST) for Digital Services in Malaysia

In the hyper-growth world of tech startups, compliance often takes a backseat to coding and customer acquisition. However, in 2026, the Malaysian tax landscape has shifted significantly. With the …

The 5 Red Flags: Is It Time to Change Company Secretaries in Malaysia?

In the current business landscape of 2026, the role of a company secretary has evolved far beyond mere administrative support. Every registered company in Malaysia requires at least one secretary …

The Foreign Service Fee Trap: A Guide to Withholding Tax in Malaysia

Navigating the tax system in any country can be complex, but in Malaysia, one specific area often catches business owners off guard: withholding tax.

Failure to understand your obligations as …

Register a Domain Name in Malaysia: Why Your Sdn Bhd Brand and Local Business Needs a .com.my Online Brand

When setting up an Sdn Bhd in Malaysia, one of the most critical digital decisions you will make is choosing your domain. While the global “.com” is often …

Stamp Duty

What is Stamp Duty?

Stamp duty is imposed on instruments, not on transactions. Instruments subject to stamp duty include agreements, contracts, deeds, licences, and other documents specified under the Stamp …

Letting of Real Property

In Malaysia, the Income Tax Act 1967 taxes income from real property as either a business source under Section 4(a) or a non-business source under Section 4(d). This classification determines…

Tax Treatment for Investment Holding Companies (IHC)

If your company’s primary activity is holding investments, it is essential to know if you qualify as an Investment Holding Company (IHC) under Malaysian tax law. This classification determines how …

Reinvestment Allowance (RA) – Manufacturing Segment

Reinvestment Allowance is a tax incentive aimed at encouraging existing manufacturers to reinvest in their operations. Eligible companies can claim a deduction of 60% of qualifying capital expenditure incurred on …

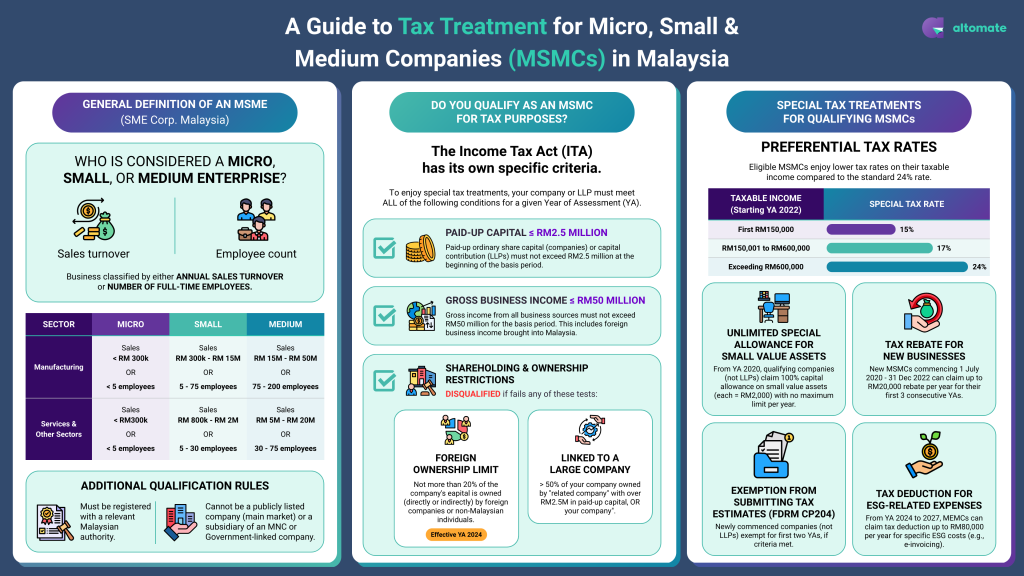

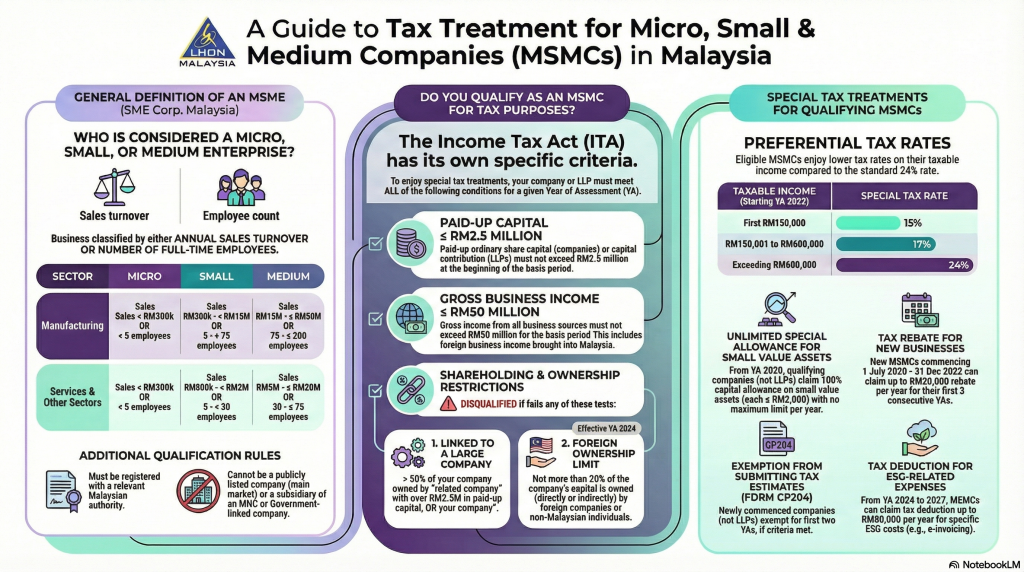

Tax Treatment for Micro, Small and Medium Companies (MSMC) in Malaysia

Under the Malaysian tax system, MSMCs enjoy specific tax incentives and tax treatment designed to support small and medium enterprises. This comprehensive guide details the tax obligations, tax benefits, and …

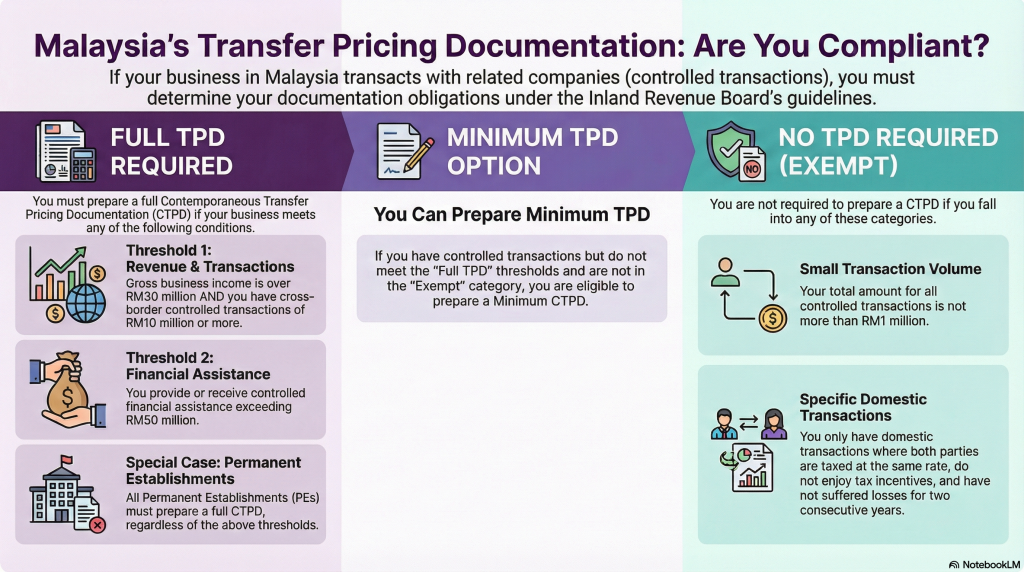

Transfer Pricing

The Malaysia Transfer Pricing Guidelines 2024 (“MTPG 2024”) represent a significant update to the country’s transfer pricing (TP) framework and are effective for years of assessment (YA) 2023 onwards. Issued …