What is payroll?

Payroll is a word with two possible meanings. It can mean the accounting process of paying your staff – including the amounts for each person and the overall total. It can also mean the list of your paid employees.

We’ll look at both meanings in this guide, because understanding payroll is all about understanding the accounting regulations that cover how and when to pay your employees.

Payroll is an important part of business accounting, for two big reasons. First, because it’s a legal requirement to get it right, especially for tax purposes. Second, if you don’t pay your employees correctly then they probably won’t be your employees for long!

So here’s what you need to know in order to understand payroll for your small business.

Five areas of the law to understand about payroll

Detailed regulations about payroll will vary from one jurisdiction to another. However, there are some areas of the law that are likely to be in force wherever you run your business:

1. Taxation

Any business with staff must withhold the proper payroll taxes from employees’ pay packets and pay the appropriate government taxes.

In short, you’re acting as the tax collector for your employees.

2. Retirement plans and healthcare

You may also have to manage payments for things like social security and healthcare and this will vary from country to country.

That means withholding the right amounts from your employees’ pay and, usually, paying employer’s contributions too.

Sometimes these are fixed amounts, sometimes they’re a percentage of each employee’s salary.

3. Payroll is for employees

Your payroll legally includes the people you directly employ. It doesn’t usually include independent contractors or freelance workers, or anyone who invoices you through their own business.

If you’re ever in doubt about who’s on your payroll and who isn’t, talk to your accountant.

4. Fines and penalties

If you don’t pay the necessary taxes you could receive a heavy fine or other penalty, so it’s important to calculate the amount of payroll taxes owed and pay them on time.

5. Reporting

Tax liabilities must be reported to the appropriate government agencies, and your employees, in writing.

This might be done weekly, monthly or yearly, depending on local regulations.

In certain countries you may have other obligations too, such as paying funds towards unemployment cover, or checking that each employee is legally allowed to work in your country.

Understand what to do when your payroll changes

Your payroll isn’t fixed – it will vary as you hire new employees. Whenever a new employee joins your business, make sure all the correct government tax documentation is completed and filed.

Payments to the people on your payroll will vary too and you’ll need to include them in your system in different ways. Some examples include:

- Salaried worker

Someone who’s paid a fixed salary for each pay period. - Regular hourly or casual employee

Paid an hourly rate for a certain number of hours each week. - Commission

Paid for services rendered, products or services sold, usually on a percentage basis. - Bonus

Paid for good performance over and above expected levels. - Supplemental wages

A catch-all term that includes bonuses, commissions, overtime pay, payments for accumulated sick leave, severance pay, awards, prizes, back pay, retroactive pay increases, and payments for nondeductible moving expenses.

Archive your payroll records

The government will want you to keep payroll records for several years. For example, in the US and the UK you must keep records for the current tax year and the previous three tax years. These records should include the following information, for each employee:

- Name, address and your country’s welfare ID number (for example, in the US this would be your social security number). Check this according to your country’s local regulations.

- Date of hire.

- Date of termination (if not still employed by you).

- Amounts and dates of all wage, annuity and pension payments.

- Copies of all relevant forms supplied to (and by) the employee.

- Details of sickness or injury payments, including dates, amounts and who made the payments.

- Dates and amounts of tax deposits you made.

- Copies of returns filed and confirmation numbers.

- Records of fringe benefits and expense reimbursements provided to your employees.

There may also be other information that you’re legally obliged to keep. Check with your local tax office to find out.

Payroll is your responsibility to get right

You might choose to handle payroll operations yourself in-house, or you might decide to outsource them to an accountant or payroll company. Either way, business owners are responsible for keeping accurate records and filing them with the tax office. So it’s important to take the time to get it right.

You can make life easier for yourself by choosing the right payroll accounting software and setting it up properly. Get whatever help you need from your accountant and the tax office to make sure this is done properly. Putting in some effort now will save you tons of time and expenses as your business grows and you take on new employees.

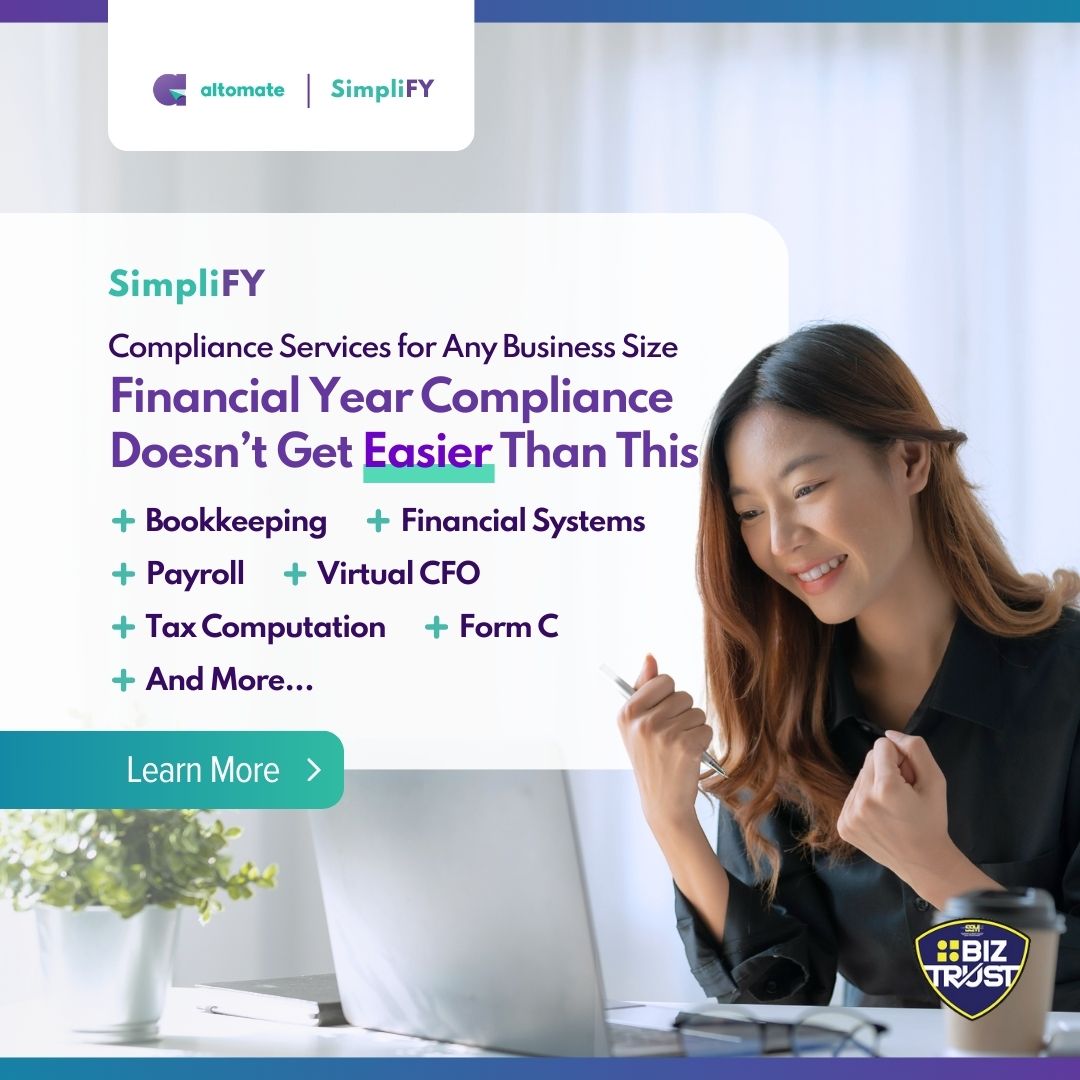

Wanna know more? Take a look at our payroll services here!

Source: Xero.com