The Malaysia Transfer Pricing Guidelines 2024 (“MTPG 2024”) represent a significant update to the country’s transfer pricing (TP) framework and are effective for years of assessment (YA) 2023 onwards. Issued by the Inland Revenue Board of Malaysia (IRBM) on 24 December 2024, the 2024 Guidelines align Malaysia’s domestic TP regime with international standards and provide clearer, more detailed expectations on documentation, compliance, and audit procedures.

1. Does Your Business Need Transfer Pricing Documentation?

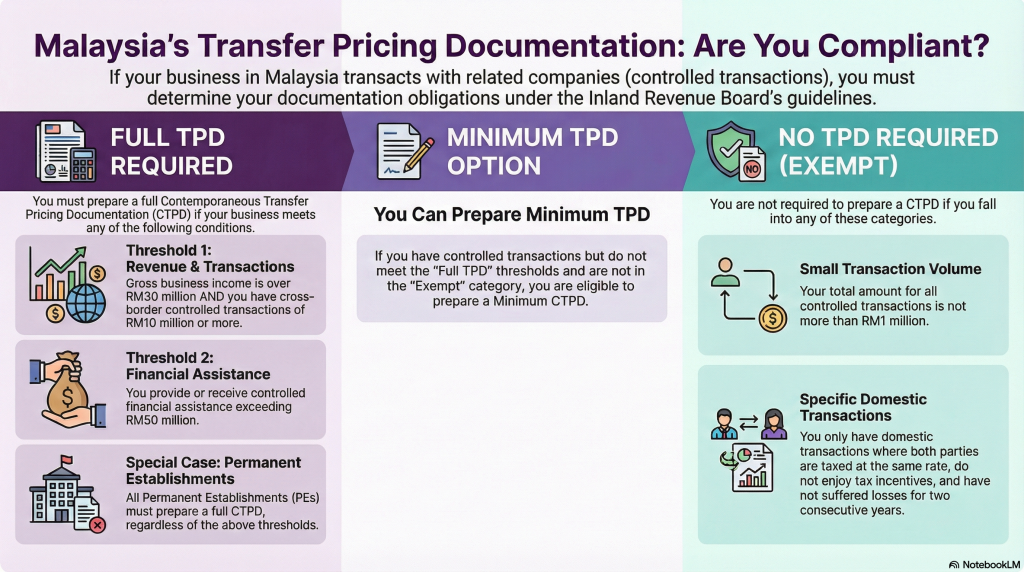

Any person entering into controlled transactions whether domestic or cross-border must prepare contemporaneous transfer pricing documentation (CTPD) to support the arm’s length nature of those transactions.

A. Who Must Prepare a Full CTPD?

You are required to prepare a Full Contemporaneous Transfer Pricing Documentation if you meet either of these thresholds:

- Income & Cross-Border Limit: Gross business income exceeds RM30 million AND total annual cross-border controlled transactions are RM10 million or more annually.

- Financial Assistance Limit: Provides or receives controlled financial assistance (loans, advances, etc.) exceeding RM50 million annually.

- Permanent Establishments (PE): A PE must prepare a full CTPD regardless of whether it meets the above thresholds.

B. Who Can Prepare a Minimum TPD?

Taxpayers that do not meet the thresholds for Full CTPD but still engage in controlled transactions may prepare a Minimum CTPD, which has simplified documentation requirements focused on capturing the essential elements of the related-party dealing

C. Who is Exempted?

The MTPG 2024 expands exemptions. A person is generally not required to prepare CTPD if they fall into one of the following:

- Individuals not carrying on a business.

- Individuals carrying on a business (including partnerships) engaged only in domestic controlled transactions.

- Persons with total controlled transactions (domestic + cross-border) ≤ RM1 million annually.

- Persons engaged solely in domestic controlled transactions where both related parties:

- are taxed at the same statutory tax rate,

- do not enjoy tax incentives, and

- have no tax-loss position in the previous two years.

Even if exempted, taxpayers must still comply with the arm’s length principle and retain supporting records as evidence

2. Key Compliance Rules & Deadlines

- The “Contemporaneous” Rule: CTPD must be prepared before the due date for filing the income tax return for the relevant year of assessment. It must be dated to show the completion date and must comply with the contents prescribed under the TP Rules 2023.

- Submission Timeline: You do not submit the CTPD with your tax return. However, if LHDN requests it, you must furnish the documentation within 14 days.

- Update Frequency: While a full benchmarking analysis can be refreshed every three years (if business conditions are unchanged), financial data must be reviewed and updated every year.

3. Penalties for Non-Compliance

Failure to comply with the new Transfer Pricing 2.0 framework carries significant risks:

- Failure to Furnish TPD: If convicted, a fine between RM20,000 and RM100,000, or imprisonment up to 6 months, or both.

- Surcharges: For assessments from 1 January 2021, a surcharge of up to 5% may be imposed on any transfer pricing adjustments made by LHDN, even if no additional tax is payable.

Need more help? Transfer pricing is highly technical, involving functional, asset, and risk (FAR) analysis. If you have related-party loans, management fees, or intercompany sales, please reach out to our support team or consult with a tax professional.

Source: Transfer Pricing Compliance & Criteria for SMEs (TP 2.0 Guidelines)