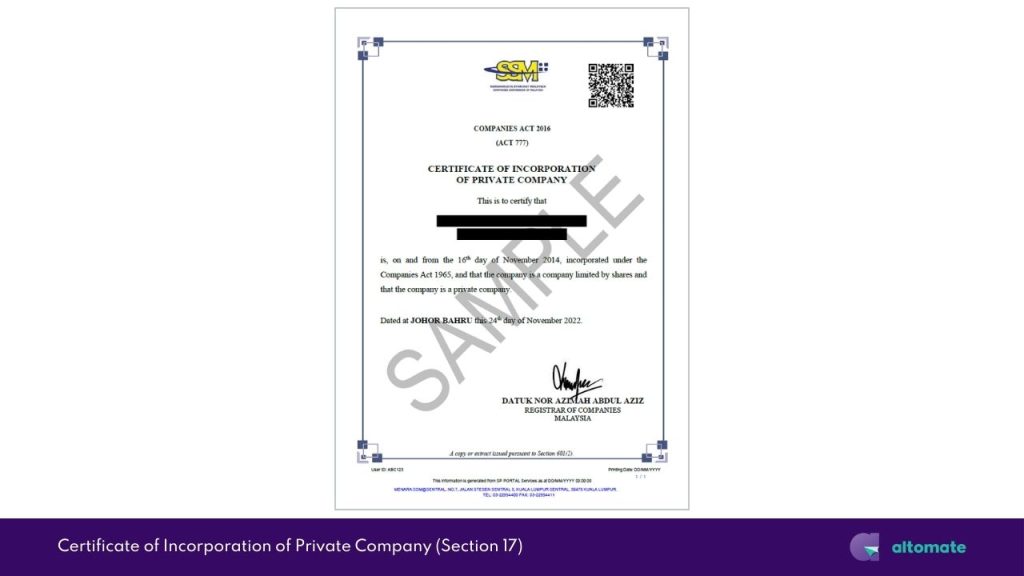

This guide will show you how to use Altomate to incorporate your company in just 3 days and get your Certificate of Incorporation of Private Company (Section 17) shipped to your doorstep.

Here is a quick overview of our fully online process, typically completed within 3 business days:

- Create an Altomate account.

- Complete identity verification (e-KYC).

- Fill and submit incorporation form.

- Pay RM2,695 (includes tax and 1-year Essential Company Secretary service).

- Altomate manages all SSM incorporation procedures for you:

- Altomate will perform a Name Search.

- Altomate will fill out and Submit the Super Form.

- Altomate will make a payment of RM1,010.60 (includes tax).

- Altomate will respond to any SSM Officer questions.

- Altomate will make all documents accessible in your Altomate account. Includes Super Form (Section 14), Notice of Registration (Section 15), and Certificate of Incorporation (Section 17)

- Altomate will courier the CTC (Certified True Copies) documents to you.

- Altomate will begin post-incorporation compliance work.

- You will receive CTC documents via courier.

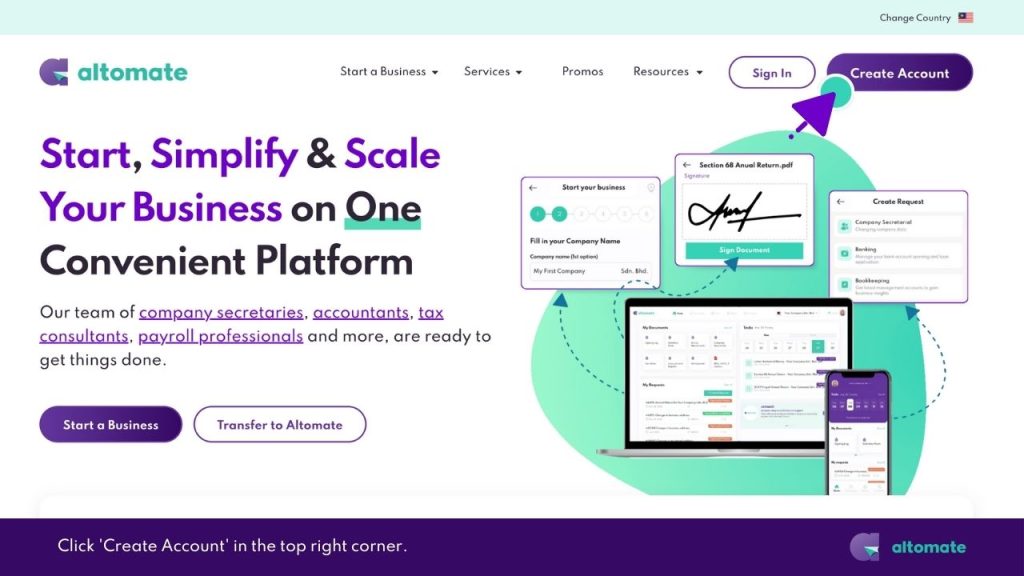

Create Your Free Altomate Account

- Click ‘Create Account‘ in the top right corner.

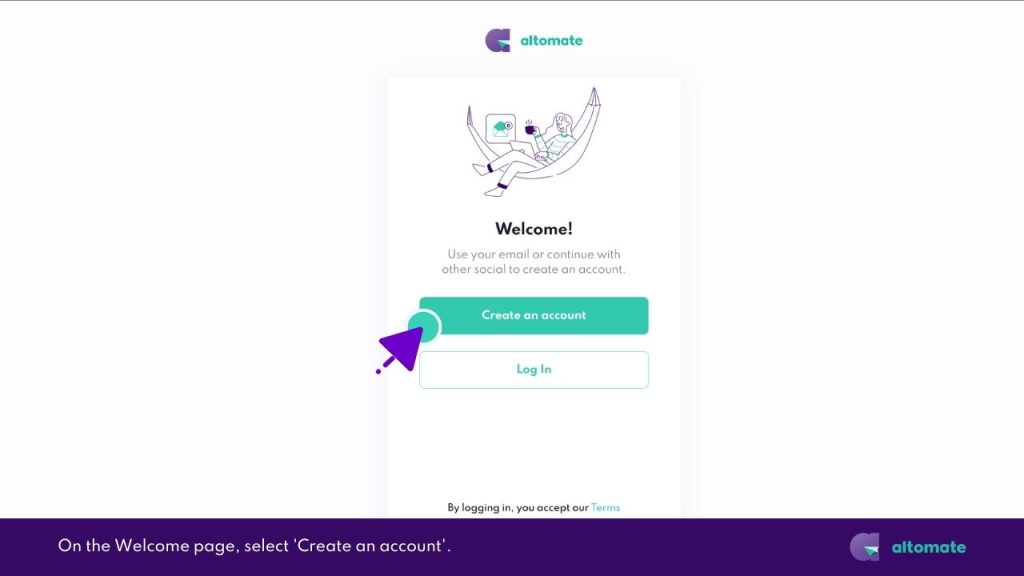

- On the Welcome page, select ‘Create an account‘.

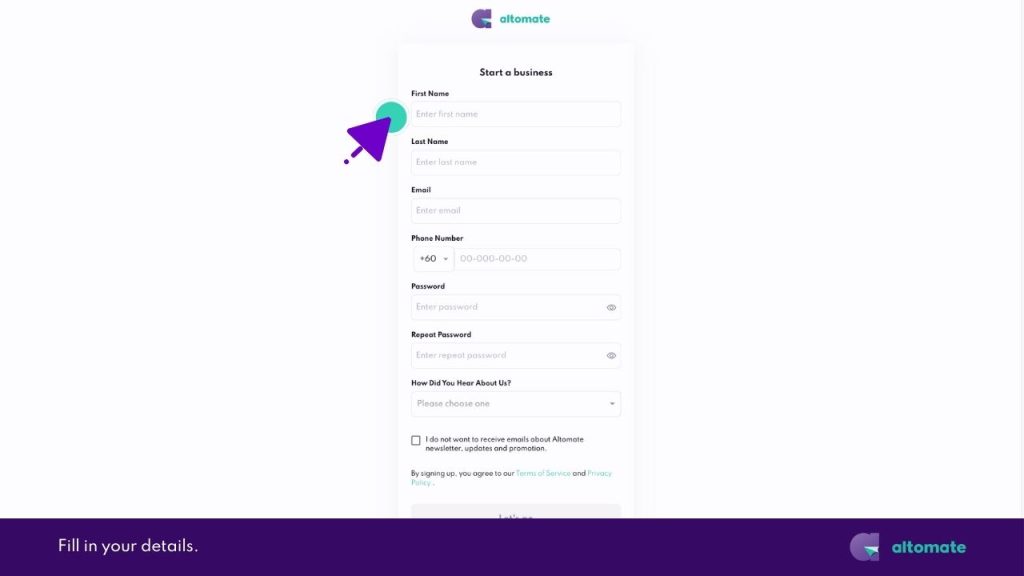

- Fill in your details:

- First Name

- Last Name

- Email (This will be your username)

- Phone Number (For verification code)

- Password

- How you heard about us

- Click ‘Let’s Go‘.

- Enter the 4-digit verification code sent to your phone.

- Click ‘Let’s Go‘ .

- Your Altomate account is now created, and you’ll be redirected to the Dashboard.

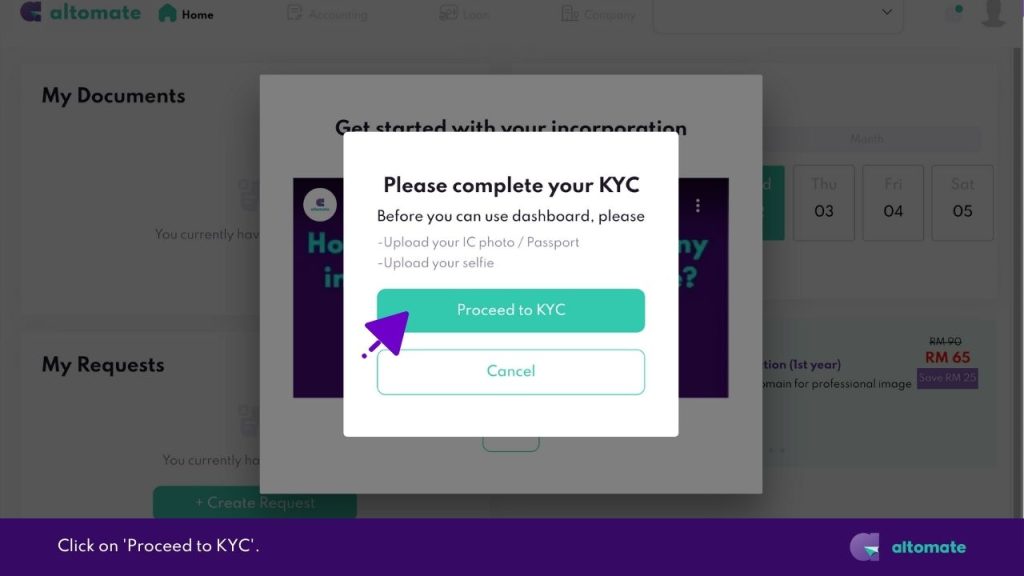

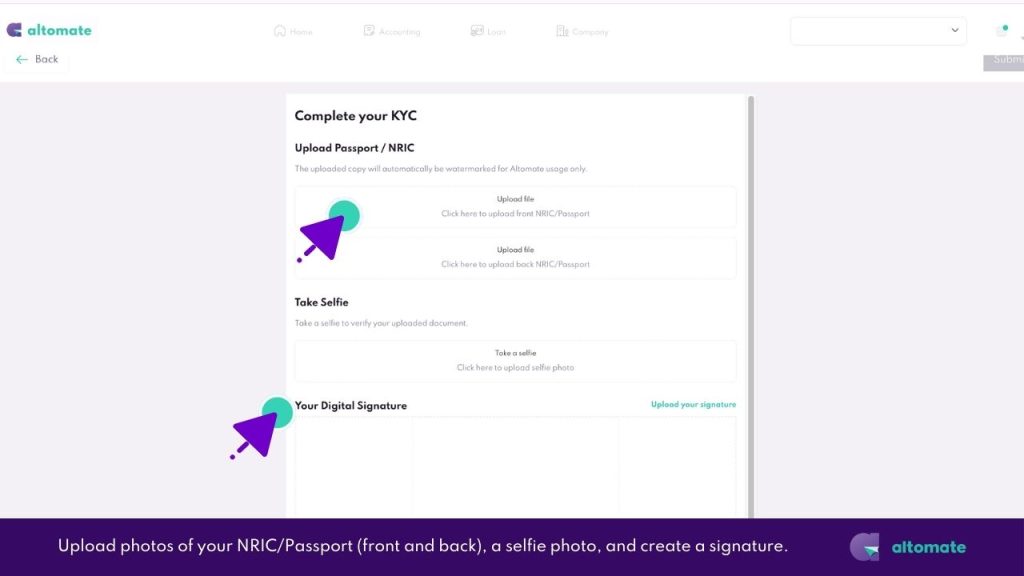

Complete Identity Verification (eKYC)

Our identification and verification (eKYC) process is part of our ongoing efforts to combat fraud, corruption, money laundering, and terrorist financing. This aligns with the requirements set by the AML/CFT/CPF and TFS for FIs policy.

- An eKYC pop-up will appear. Click on ‘Proceed to KYC‘.

- On the Complete Your KYC page, upload photos of your NRIC/Passport (front and back).

- Upload a selfie photo.

- In the Your Digital Signature section, create a signature to use for signing documents in Altomate:

- Option 1: Use your mouse to draw your signature in the box.

- Option 2: Click ‘Upload your signature’ to use an image of your handwritten signature.

- Click ‘Submit‘ in the upper right corner of the page.

- Your identity verification has been submitted.

Next, let’s fill out the incorporation form.

Fill Out the Incorporation Form

Convenient Form Feature – You can pause the form-filling process at any time. Your progress is automatically saved, allowing you to resume exactly where you left off.

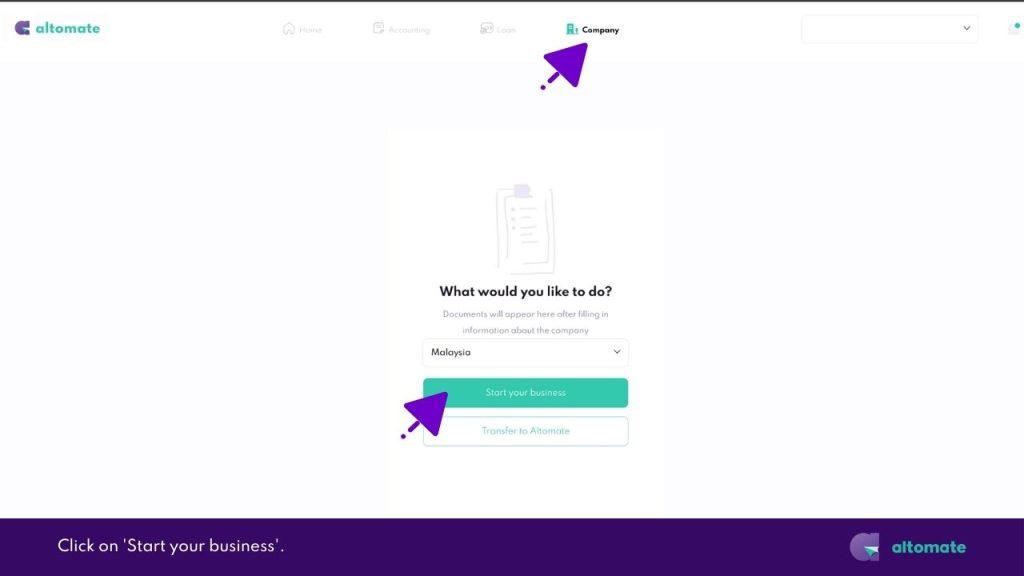

- On the top navigation bar, click on the ‘Company‘ tab.

- Then click on ‘Start your business‘.

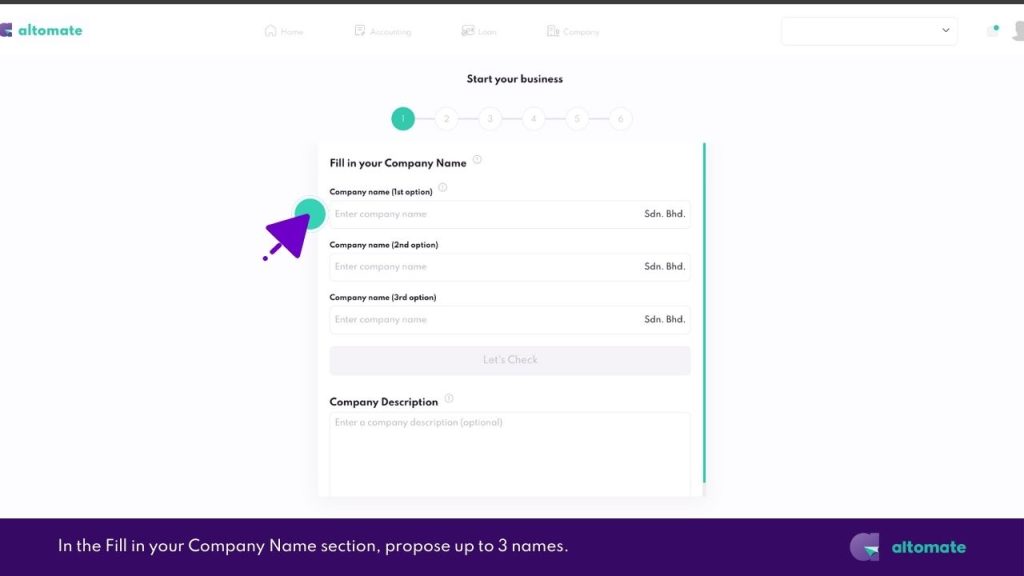

» Page 1

- In the Fill in your Company Name section, propose up to 3 names. We will perform a name check and proceed with the first available option.

- In the Company Description, explain your company name.

If your company name contains the name of an individual who is not a director and is a director’s family member:- In the text box, describe the relationship between the named individual and the director.

- Send proof of relationship via WhatsApp (+6011-1100 8882).

E.g.: If the proposed name is ‘Ali Technology’, explain that Ali is the director’s son and send a copy of Ali’s birth certificate as proof of relationship.

- Click ‘Next‘ to continue.

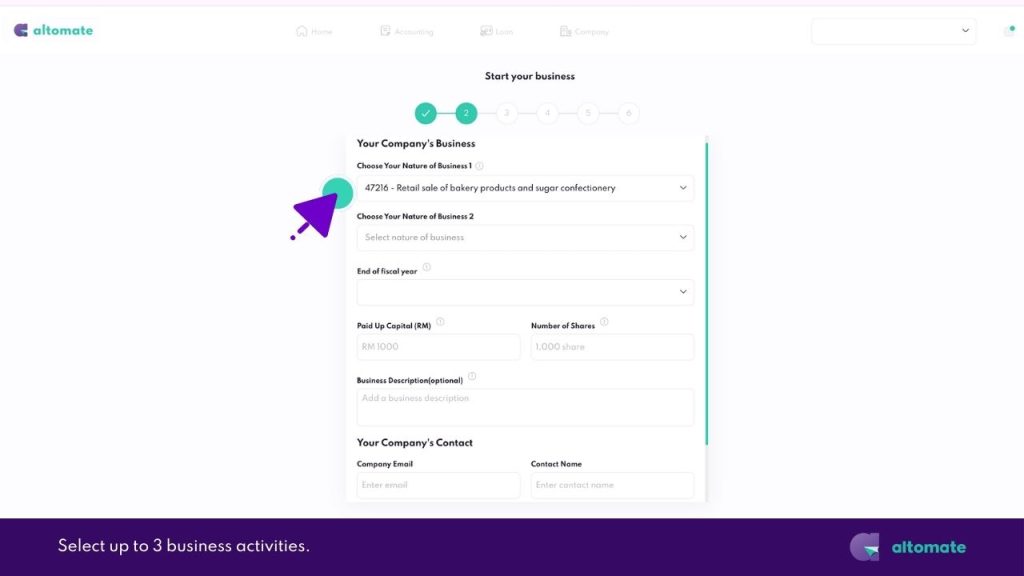

» Page 2

- On page 2, select up to 3 business activities:

- Type a keyword and select from dropdown list of suggested codes.

E.g., if you are opening a cafe, just enter the keyword “coffee”. A list of relevant business codes will appear.

- Type the code and select from the dropdown list of suggested code.

E.g., type “47216”, the business code “47216 Retail sale of bakery products and sugar confectionary” will appear in the dropdown list. Click it to select it.

- Choose your fiscal year-end date.

- Enter your Paid-Up Capital.

- If you are the sole owner of the company, a minimum of RM1 paid-up capital is required. Recommended minimum paid-up capital is RM1,000.

- If all shareholders are Malaysian, the recommended minimum paid-up capital is RM1,000.

- If the company has one or more non-Malaysian (foreign) shareholders, the recommended minimum paid-up capital is RM5,000. This amount meets the minimum requirement set by most banks for opening an account when foreign shareholders are involved.

Depending on the nature of your business, different minimum paid-up capital amounts are required by regulatory bodies and banks. If you are not sure, just reach out to us and we will help you figure it out.

- Enter the Number of Shares. We recommend each share be valued at RM1.

E.g. if your Paid-Up Capital is RM1,000, enter “1000” in the Number of Shares field.

- Optionally, add a Business Description for details not covered by Business Codes.

E.g.: Altomate’s business description is “To carry on the business of providing digital company secretarial services and other related corporate services, to offer comprehensive bookkeeping, tax compliance, and consultancy services, to deliver payroll management solutions, to facilitate POS & e-commerce integration with accounting software, and to provide other information technology service activities. Additionally, to act as a digital business assistant and enabler, supporting startups, SMBs, and SMEs in their growth and compliance efforts, and to offer management consultancy services and other related business support services.”

- Fill in your company contact information.

- Click ‘Next‘.

» Page 3

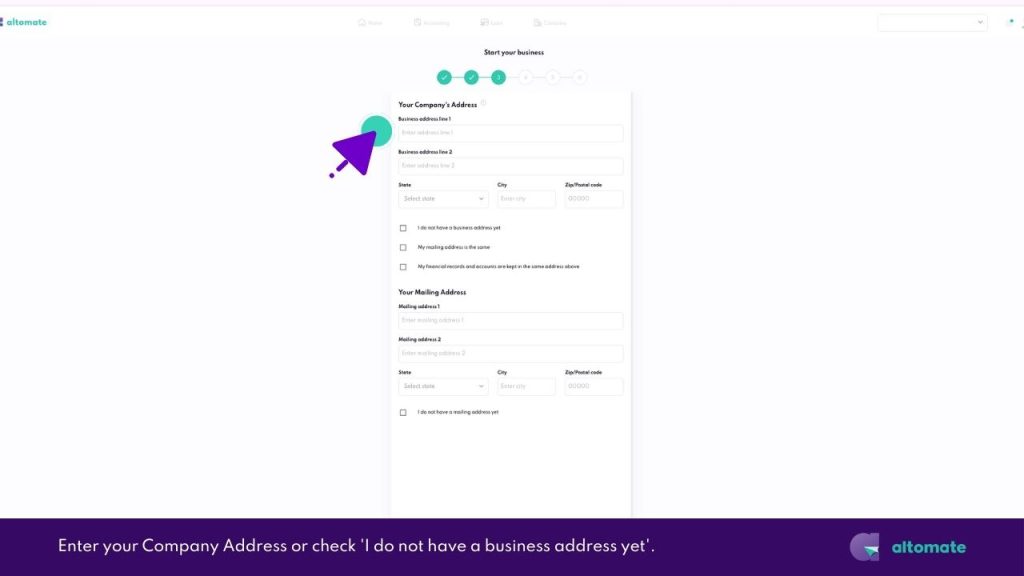

- On page 3, enter your Company Address or check ‘I do not have a business address yet’.

- Enter your Mailing Address. We will courier your Certified True Copy (CTC) documents (Certificate of Incorporation, etc.) to this address.

- Click ‘Next‘.

» Page 4

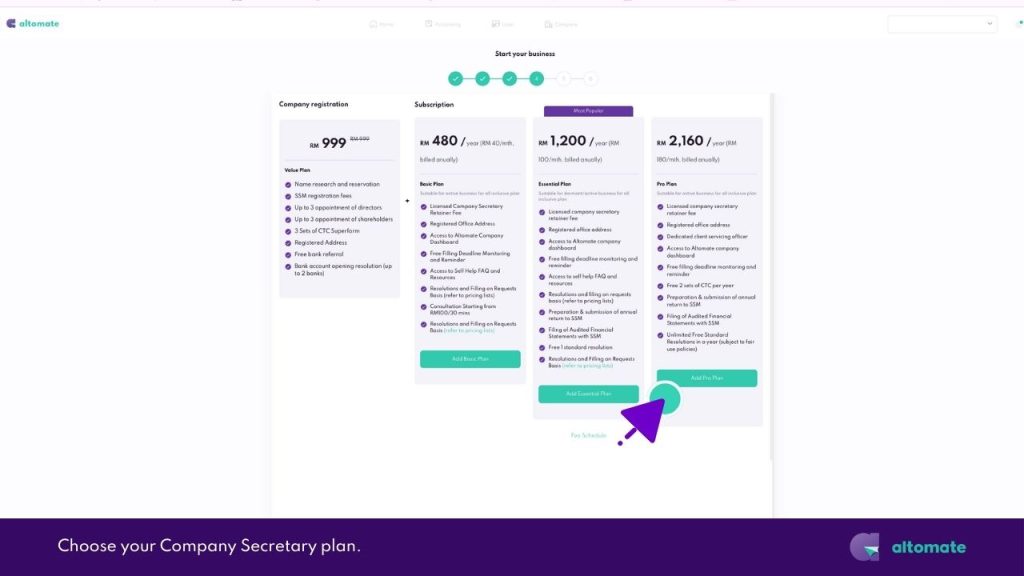

- On page 4, choose your Company Secretary plan:

- PRO: Recommended for active businesses

- Essential: Suitable if you’re unsure about your needs

Incorporation service is RM1,399 with all packages and is inclusive of the SSM fee (RM1,010).

- Click ‘Add Essential Plan‘ to proceed.

- Select any additional partner services.

- Click ‘Next‘.

» Page 5

Add Shareholders

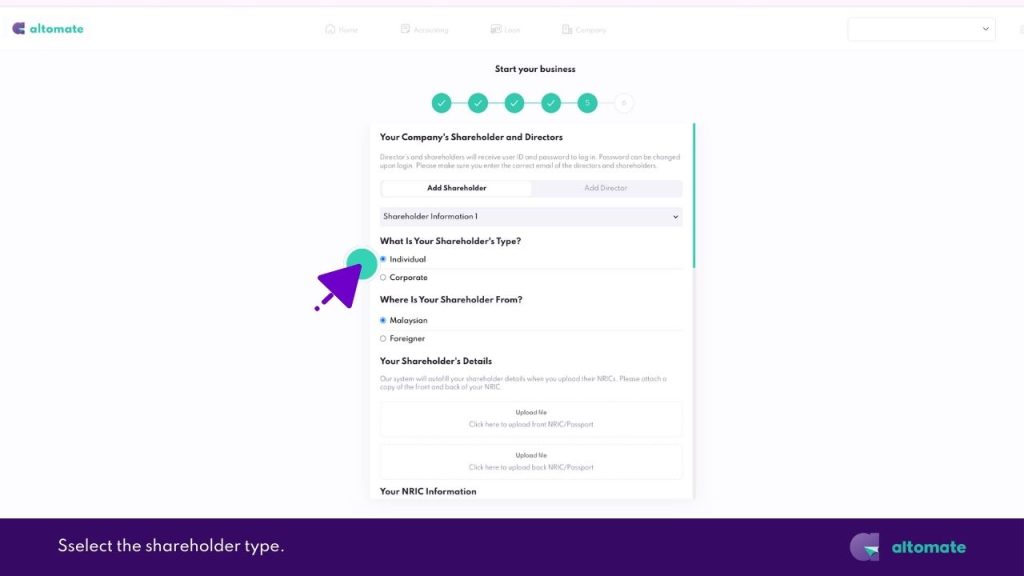

- On page 5, starting on the Add Shareholder tab > Shareholder Information 1, select the shareholder type.

- If you are the sole owner, fill in your personal and contact information. Then skip the next step.

- To add more shareholders, click on ‘+ Add New Shareholder‘.

Important: Each shareholder’s email address must be unique. We will automatically create an account for each email provided. A temporary password will be sent to each shareholder’s email. Shareholders can then use their account to sign documents through the Altomate app. - When you have finished adding shareholders, click ‘Next‘, then click ‘No‘ in the confirmation pop-up to go to the Add Director tab.

Add Directors

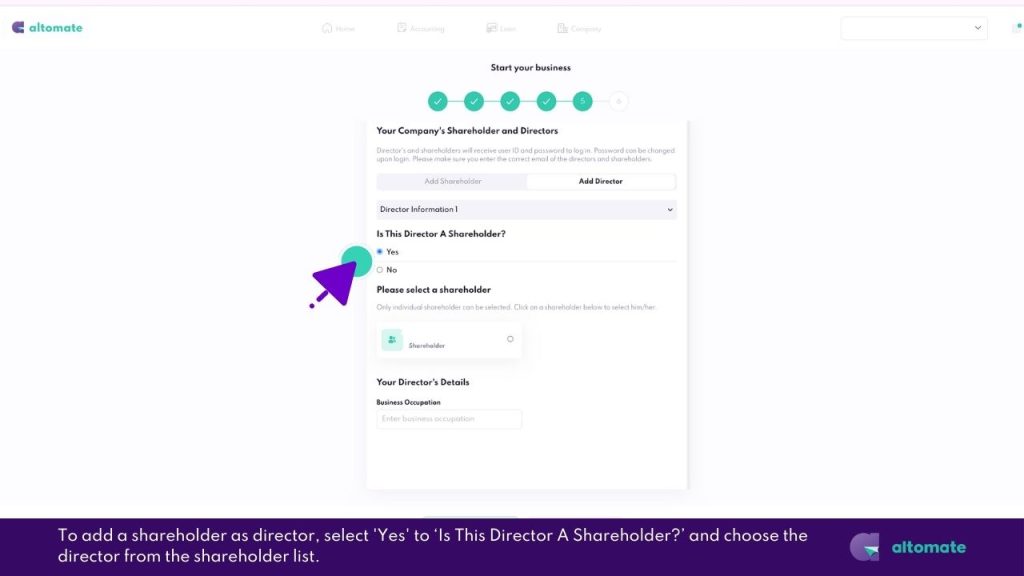

- On the Add Director tab, to add a shareholder as director:

- Select ‘Yes‘ to Is This Director A Shareholder?

- Choose the director from the shareholder list.

- Enter the director’s occupation.

- If you are the sole owner, skip to the last step.

- To add a director who is not a shareholder:

- Select ‘No‘ to Is This Director A Shareholder?

- Enter the director’s occupation.

- Enter the director’s personal and contact information.

Important: Each shareholder’s email address must be unique. We will automatically create an account for each email provided. A temporary password will be sent to each shareholder’s email. Shareholders can then use their account to sign documents through the Altomate app.

- To add more directors, click on ‘+ Add New Director‘.

- When you have finished adding directors, click ‘Next‘, then click ‘No‘ in the confirmation pop-up to go to the Checkout page.

» Page 6

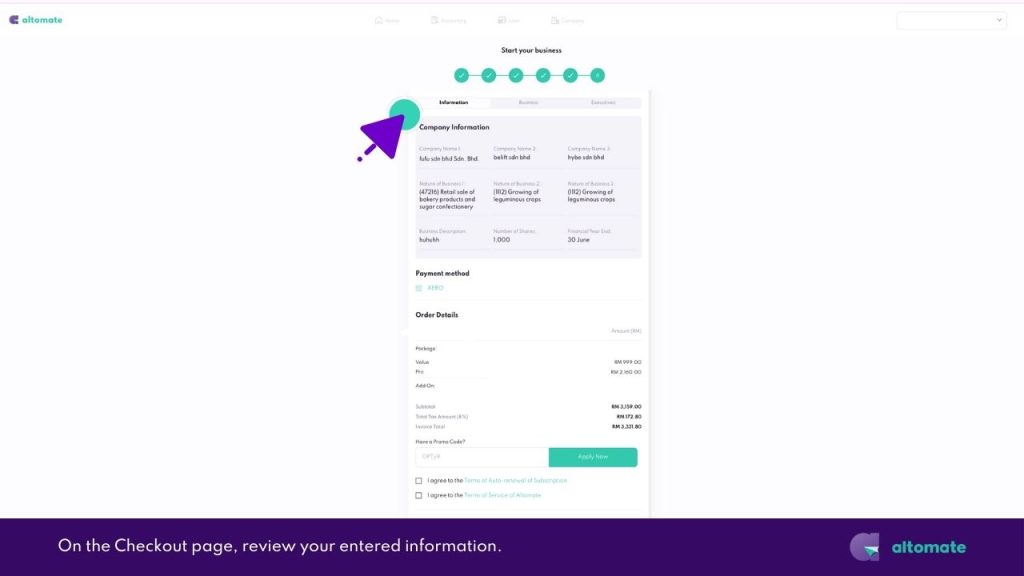

- On the Checkout page, review your entered information.

- Enter your Promo Code if you have one.

- Check the box to agree to the terms of auto-renewal and terms of service.

- Click ‘Submit‘ and then ‘Pay Now‘.

Once payment is successful, our team will begin the process of incorporating your company.

The Altomate Team Takes Over From Here

After payment, there is nothing left for you to do.

Expect to receive your Notice of Registration (Section 15) and Certificate of Incorporation (Section 17) in about 3 days, unless the SSM officer requests additional information.

During this period, we are:

- Reviewing your information for any issues to prevent potential delays.

- Performing a name check for your company. If your first choice is available, we will proceed with the incorporation. Otherwise, we will contact you to confirm the other options.

- Filling out and submitting the Super Form to SSM in the correct format.

- Handling all queries from the SSM officer (e.g., due to company name issues or foreign shareholders). We will contact you directly if they require information beyond what you’ve provided, with specific guidance on next steps.

- Making all documents available in your Altomate account to download, sign, or view.

Once Your Incorporation Is Approved by SSM

We will notify you and:

- Get your documents certified as true copies(CTC).

- Send the CTC documents to you via courier.

- Begin post-incorporation compliance work, including bank account opening and company secretary appointment.